Market Ahead, November 3: Top factors that could guide markets today

Market Ahead, November 3: Top factors that could guide markets today

A total of 90 companies including Sun Pharma, Adani Gas, Dabur India, and PVR are scheduled to announce their quarterly results today

BS Web Team New Delhi

)

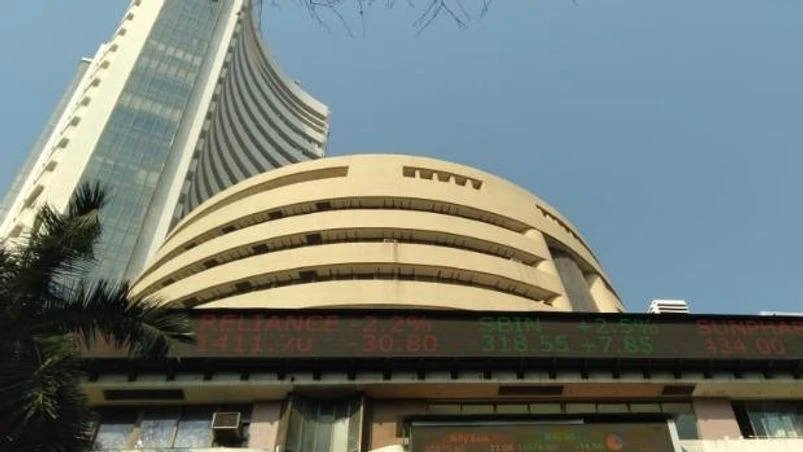

Photo: Kamlesh Pednekar

The Dow and S&P closed higher on Monday with the Nasdaq posting slimmer gains on the eve of the US presidential election, as investors girded for what could be big market swings this week. Democrat candidate Joe Biden leads in national opinion polls, but races are tight in battleground states that could tip the election to Republican candidate Donald Trump. Analysts said the outcome most likely to shake equity markets in the near term would be no clear winner on Tuesday night. The counting of votes will begin around 5.30 am (Indian Standard Time) tomorrow.

The main Wall Street indices posted strong gains in overnight deals ahead of the polls. The Dow rose 1.6 per cent, the S&P 500 gained 1.2 per cent and the Nasdaq added 0.4 per cent.

Asian indices were also firm in Tuesday's early deals., Australia's ASX 200 gained 1.75 per cent, Hong kong's main index rose 1.4 per cent and South Korea's Kospi also surged 1.6 per cent.

Consequently, the SGX Nifty was also ruling at 11,754 levels, up 84 points, indicating a strong opening for the domestic indices today.

Even for investors back home, the US elections will remain a major trigger and as such, market participants will track the newsflow regarding the same, Besides, votes will be cast for 94 seats in the second phase of Bihar Assembly elections while the Supreme Court will resume hearing on the interest waiver case.

Also Read

Apart from these, corporate results and stock-specific developments will trigger individual stock moves.

State-owned Punjab National Bank posted a net profit of Rs 621 crore in the second quarter – a 22 per cent jump from Rs 507 crore in the year-ago period. The bank’s net interest income soared 29 per cent to Rs 8,393 crore from the year-ago period. Shriram City Union Finance reported a nearly 10 per cent year-on-year fall in consolidated net profit at Rs 275 crore for the quarter. All these stocks will react to their numbers today.

A total of 90 companies including Sun Pharma, Adani Gas, Dabur India, and PVR are scheduled to announce their quarterly results today.

NTPC is expected to trade actively today after the its board approved the buy back of 197.8 million equity shares at a price of Rs 115 per unit for a total consideration of Rs 2,275.74 crore. The company has fixed November 13, 2020 as the record date for the buyback.

Larsen & Toubro might also be in focus after emerging as the lowest bidder for the C6 package of the National High-Speed Rail Corporation’s bullet train project, at Rs 7,289 crore. This is the second contract for the company in the mega project.

And, India's Covid-19 case tally has soared to 82.66 lakh while the country's death toll has mounted to 1.23 lakh, according to Worldometer.

More From This Section

Topics :Market AheadMarkets

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Nov 03 2020 | 7:52 AM IST