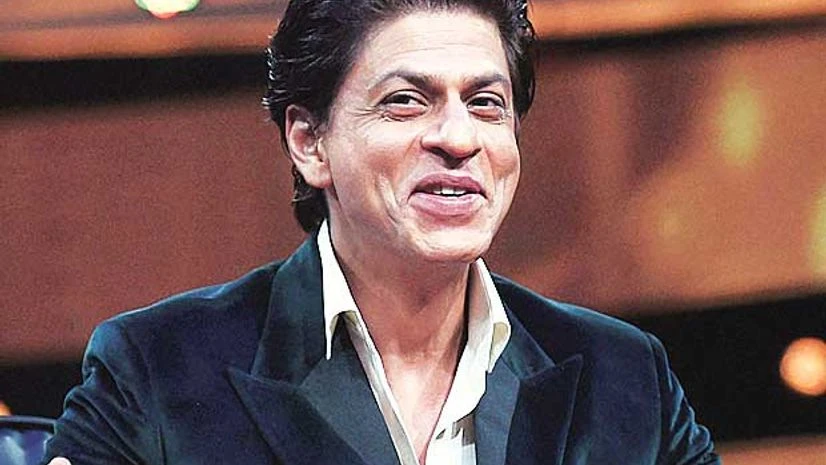

Bollywood superstar Shah Rukh Khan will have to include notional rent from his villa in Dubai in his income tax returns filed in India, said a ruling by the Income Tax Appellate Tribunal (ITAT), the Economic Times reported on Thursday.

The development comes right on the heels of Khan finally winning his income tax case scrutinising his earnings from his stint on the quiz show Kaun Banega Crorepati.

According to the financial daily, Khan had contended that income from immovable property in Dubai would be liable to be taxed only in the UAE under the India-UAE

)