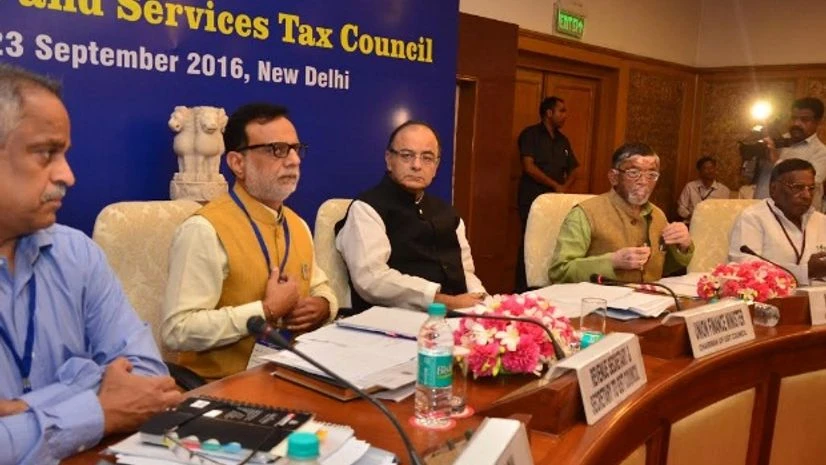

Eyeing April 1, 2017 roll out for GST, the GST Council on Friday resolved two contentious issues - a threshold over which the new indirect tax would apply and dual control of their tax officials over assesses.

The threshold has been fixed at Rs 20 lakh annual turnover. This means an entity having daily sales worth around Rs 5,500 would not come under the GST bracket.

On Thursday, some states like Uttar Pradesh stuck to their demand of Rs 10 lakh of turnover and other states such as Delhi along with the Centre demanded Rs 25 lakh of turnover.

The other contentious issue of dual control over assesses was also resolved. Now the state officials will have sole power over assesses up to Rs 1.5 crore of annual turnover in case of goods. In such cases, both the central and state officials would have jurisdiction. However, in case of services, both central and state officials will have power over assessees throughout.

An agreement on methodology for compensation to states for full five years is yet to be arrived at.

While the next meeting of the Council on September 30 will finalise draft rules on granting exemptions, the GST rate and tax slabs would be decided at its three-day meeting beginning October 17.

While the next meeting of the Council on September 30 will finalise draft rules on granting exemptions, the GST rate and tax slabs would be decided at its three-day meeting beginning October 17.

)