Aurobindo's US operations get growth boost; stock up 9% on Sandoz deal

Attractive valuations, large portfolio add to growth pipeline, keep leverage ratios moderate

)

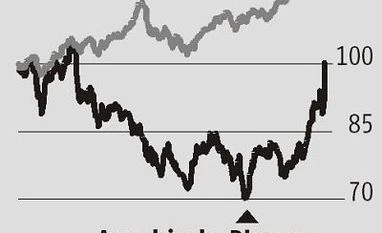

premium

Last Updated : Sep 07 2018 | 5:30 AM IST

Aurobindo Pharma, one of the largest vertically-integrated pharmaceutical companies in the country, continues with it acquisition-led growth strategy, announcing yet another buy in the US.

It is acquiring commercial operations and three manufacturing facilities from Sandoz Inc, which will help it become the second largest generic player in the US by number of prescriptions.

The acquired portfolio will include oral solids (70 per cent) and dermatology products (30 per cent).

The Street gave a thumbs up to the deal, with the stock gaining over nine per cent on Thursday.

The deal, valued at about one-time sales, will also make Aurobindo the second largest dermatology player in the US. The company can utilise this leadership to drive overall sales growth on the back of a diversified portfolio, which comprises 300 products including projects under development. This will further drive future prospects as the firm’s pipeline of pending approvals will get a substantial boost, say analysts.

All these are positives that outweigh the $900 million of cash outgo for the acquisition.

Sarabjit Kour Nangra at Angel Broking says it is a good move by Aurobindo, similar to acquisitions announced earlier; none of them are expensive, opening up good growth opportunities at the same time. The company’s European acquisitions have been growing an impressive 57 per cent annually over FY14-18, and now contribute a fourth to overall revenues.

The US, with above 40 per cent contribution to overall revenues, has also grown 20 per cent annually during the period. Analysts feel the momentum will be driven by the current acquisition.

Factors that analysts remain watchful on include profitability of the acquired business, debt levels after acquisition, and the cost of debt. Ranvir Singh at Systematix Shares feels the net debt-to-equity ratio, after completion of the deal, should remain at about 0.6-0.7 times.

On profitability, while the acquired portfolio will be in line with Aurobindo’s margins, the company can improve the same through transfer of manufacturing to India, as was the case with its European portfolio. Analysts believe the company will outperform other larger Indian pharma companies, on the back of superior portfolio and best-in-class execution.