Essel aims to repay lenders by Sept but plan unlikely to leave it unscathed

The steep falls in Zee provoked several lenders to dump over Rs 500 crore worth of pledged shares in panic

)

premium

zee

Last Updated : Feb 15 2019 | 11:11 AM IST

February 24 was Black Friday for the Essel Group, the media-to-infrastructure empire built by Subhash Chandra, when its listed companies lost over $2 billion. Flagship and cash cow Zee Entertainment Enterprises alone was hammered 26 per cent.

There were multiple provocations for the fall: allegations that one of its companies was being investigated (which was denied); and, more importantly, news that the promoters had pledged group company shares to borrow Rs 13,000 crore from non-banking financial companies, mutual funds and others to invest in infrastructure projects that are in trouble. This includes up to 59 per cent of promoters shares in Zee Entertainment.

The steep falls in Zee provoked several lenders to dump over Rs 500 crore worth of pledged shares in panic.

In a rear-guard action, Chandra did the unusual, writing an open letter that admitted to wrong decisions and apologising to lenders. An agreement with lenders, on Sunday, which includes Birla Mutual, HDFC Mutual and ICICI Mutual, gave him till September-to repay. The lenders today apprised the market regulator Securities and Exchange Board of India on the plan of the group to pay back their loans.

However, repaying the debt will come at a significant price for the group either way. “There are few promoters that have promised to clean up Rs 30,000 crore of debt in their companies. To do so, you will have to lose something substantial,” says an analyst.

So what will the promoters of the Essel group lose if the proposal to lenders is implemented without a hitch? First, it will not have a significant infrastructure business, which was one key diversification that did not work, and added around Rs 3,300 crore of revenues in Essel Infrastructure.

They might also lose control of Zee Entertainment. Two months ago, the promoters had announced that they would sell half their 41.6 per cent stake to a “strategic investor,” preferably foreign, to get technology and access to global markets. Now, they have upped the offer to a 25 per cent stake in Zee, reducing their stake to 15 per cent. A new partner would surely assert greater control, though insiders point out that they will always require an Indian partner to run a complex business. Negotiations are on with three global players, they add, but a media analyst points out that the mayhem would reduce valuations.

Company executives have told lenders that asset sales in various projects would help the promoters repay Rs 7,000 crore of loans raised against equity. This, together with the sale of a 20 per cent stake in Zee at current valuations, will give the promoters enough money to repay the entire Rs 13,000 crore loan they had taken against pledged shares

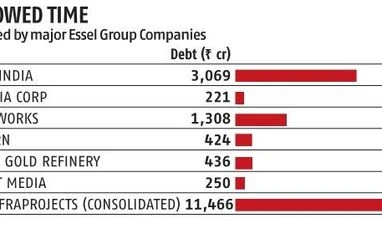

The group also hopes to reduce around Rs 12,000 crore of debt built up by group companies, mainly in Essel Infraprojects (see chart). A binding deal to sell its transmission assets to Edelweiss has already been signed. In the case of solar assets, it has signed non-binding term sheets that will be closed by March and money expected by June. Similarly, it says four companies are in the running for its road assets and a non-binding deal would be signed next week.

But analysts are sceptical that Essel will be able to sell its road assets so easily, given that attempts by ILF&S to sell similar projects have attracted little interest and potential buyers are asking for huge discounts. But sale of road assets is critical to the promise to lenders because Rs 5000 crore of promoters’ equity is stuck in them.

The crisis comes just when Zee needs substantial cash over three to five years to face the bruising battle in the over the top (OTT) space. In OTT, Netflix and Amazon have decided to invest huge amounts on local content. To compete, Zee5 has decided to do the same, aiming at over 75 hours of monthly original Indian language programming and buying at least 50 movie rights annually.

But the cash burn is not being augmented. Zee5 has only 0.3 million paying customers based on Kotak Institutional estimates, though it has over 60 million active users with a subscription revenue of only Rs 10 crore. Amazon with 12 million paid subscribers and Netflix with Rs 400 crore subscription revenues are far ahead in the monetisation game.

The Essel group also has to face Reliance Jio. It needs to upgrade technology in its cable business though Siticable by moving to fibre from copper to take on Jio’s ambitious moves to reach 50 million homes with fibre-to-home, after it acquired Hathway and Den and became the largest player in this business. Jio is also creating a platform of OTT channels, through stakes in Balaji, Eros and Voot of Viacom 18, which runs the Colors bouquet.

Chandra candidly admits that he could have left the lenders with non-performing assets and walked away. But he chose to support his business by pledging shares. The question is whether he will be able to implement his big plan, live with a strategic new investor who will have a large say in Zee, and move on.