Import curbs, India sales key triggers for Apollo Tyres

Management cautious on near-term profitability given higher start-up costs in European operations

)

premium

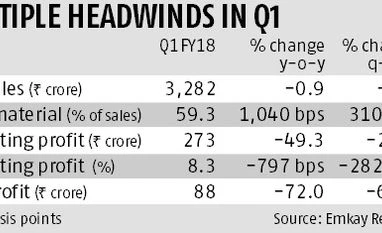

Even as the June quarter (Q1) numbers were poor, the Apollo Tyres stock clocked nine per cent gains in trade on Monday. Interestingly, even as there could be some more pain in the near term before prospects start looking better for the company, the Street is bullish on Apollo Tyres. Why?

For one, there is expectation of good growth in demand in India, as well as likely gains from favourable policy initiatives.

The management is positive about demand growth in India in the passenger vehicles segment and is hopeful of a revival in commercial vehicle (CV) demand. The initial trigger is the festive season, while improvement in the capex cycle and macroeconomic environment is expected to improve CV demand. The immediate trigger, however, is the 7-12 per cent anti-dumping duty on Chinese truck and bus radial tyre (TBR) imports. TBR imports had spurted sevenfold over three years to 1.4 million units, cornering 23 per cent of the replacement market, compared to eight per cent in FY14.

The Directorate General of Anti-Dumping and Allied Duties has recommended anti-dumping duty of $245-452 per tonne on Chinese TBR tyres. It will be implemented after the finance ministry’s nod. In a recent note, analysts at ICICI Securities said the move will minimise the threat of market share loss to cheaper Chinese radial tyres. This duty would correspond to 10-15 per cent increase in landed prices for Chinese TBR tyres.

For one, there is expectation of good growth in demand in India, as well as likely gains from favourable policy initiatives.

The management is positive about demand growth in India in the passenger vehicles segment and is hopeful of a revival in commercial vehicle (CV) demand. The initial trigger is the festive season, while improvement in the capex cycle and macroeconomic environment is expected to improve CV demand. The immediate trigger, however, is the 7-12 per cent anti-dumping duty on Chinese truck and bus radial tyre (TBR) imports. TBR imports had spurted sevenfold over three years to 1.4 million units, cornering 23 per cent of the replacement market, compared to eight per cent in FY14.

The Directorate General of Anti-Dumping and Allied Duties has recommended anti-dumping duty of $245-452 per tonne on Chinese TBR tyres. It will be implemented after the finance ministry’s nod. In a recent note, analysts at ICICI Securities said the move will minimise the threat of market share loss to cheaper Chinese radial tyres. This duty would correspond to 10-15 per cent increase in landed prices for Chinese TBR tyres.