PFC's power projects with 14,000 Mw capacity to go down insolvency alley

Around 14,000 Mw of projects, involving Rs 300 bn of its loan book, under IBC route and over half of them may have to be written off

)

premium

State-owned Power Finance Corporation (PFC) could see around 11.4 per cent of its loan book getting into the insolvency route. This includes debt-laden thermal power projects, stranded gas and hydro power units.

Officials said 14,115 Mw of capacity, at an estimated Rs 300 billion exposure to PFC, will go under insolvency proceedings.

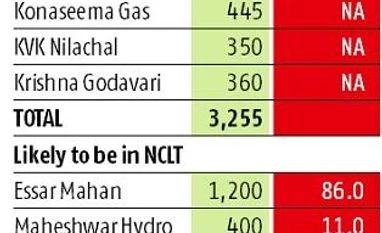

In fact, a total of 3,255 Mw projects, have already been taken to the National Company Law Tribunal (NCLT) by either PFC or one of the key bankers among the consortium of lenders, an official said. Rest of the projects, around 10,000 Mw, have six months for resolution. The time is too little, given the regulatory hurdles, he added. So, the remaining 10,000 Mw of projects could also land up in NCLT.

Those already before NCLT under the Insolvency and Bankruptcy Code (IBC) include the Konaseema gas power plant (445 Mw), coal projects of East Coast Power (1,320 Mw), KVK Nilachal (350 Mw), Ind-Barath Madras (660 Mw), Krishna Godavari (360 Mw) and the hydro power plant of JAL in Sikkim (120 Mw).

The bigger worry is about projects which have six months or less to get resolved or land before NCLT. A recent Reserve Bank of India (RBI) notification, titled ‘Resolution of stressed assets — Revised framework’, mandates banks to classify even a one-day delay in debt servicing as default. And, that resolution proceedings against stressed accounts are to be completed in 180 days. Though the directive is to banks and PFC is a non-banking financing company, its assets also get covered by this, since PFC loans are in a consortium with banks.

Officials said 14,115 Mw of capacity, at an estimated Rs 300 billion exposure to PFC, will go under insolvency proceedings.

In fact, a total of 3,255 Mw projects, have already been taken to the National Company Law Tribunal (NCLT) by either PFC or one of the key bankers among the consortium of lenders, an official said. Rest of the projects, around 10,000 Mw, have six months for resolution. The time is too little, given the regulatory hurdles, he added. So, the remaining 10,000 Mw of projects could also land up in NCLT.

Those already before NCLT under the Insolvency and Bankruptcy Code (IBC) include the Konaseema gas power plant (445 Mw), coal projects of East Coast Power (1,320 Mw), KVK Nilachal (350 Mw), Ind-Barath Madras (660 Mw), Krishna Godavari (360 Mw) and the hydro power plant of JAL in Sikkim (120 Mw).

The bigger worry is about projects which have six months or less to get resolved or land before NCLT. A recent Reserve Bank of India (RBI) notification, titled ‘Resolution of stressed assets — Revised framework’, mandates banks to classify even a one-day delay in debt servicing as default. And, that resolution proceedings against stressed accounts are to be completed in 180 days. Though the directive is to banks and PFC is a non-banking financing company, its assets also get covered by this, since PFC loans are in a consortium with banks.