ShopClues gets fresh fund, valuation rises to $1.1 bn

The e-commerce marketplace says this was its last round of fund raising and its future plans include an IPO

)

Shopclues, the e-commerce marketplace focused on budget customers in Tier-II and Tier-III cities on Tuesday said its valuation rose to $1.1 billion, making it a ‘Unicorn’ (companies valued at $1 billion or more). The valuation is on the basis of fresh funds the company raised from Singapore government's GIC and its existing investors Tiger Global and Nexus Venture Partners. According to sources, the company is said to have raised about $150 million in the current round. Shopclues said this would be the last fund raising before its public issue next year.

The Gurgaon-based firm had raised $100 million in January 2015 from Tiger Global at a valuation of $500 million.

The capital raised in the fresh funds would be used to roll out new products to enable small and medium enterprises to digitise their business and to further entrench itself as the e-commerce operating system on the cloud, Shopclues stated. ShopClues will also strengthen its branding activities and acquire smaller companies.

“We are confident that ShopClues’ merchant-first mindset and solid management team will enable the company to expand its reach, especially in the Tier-II and Tier-III cities, bringing its unique value proposition to more consumers and merchants,” said GIC’s head of Asia Equities Research, Ravi Balasubramanian.

The four-year-old company’s gross merchandise value has grown four-fold since January 2015, when it raised $100 million from Tiger Global. ShopClues, which currently ships 3.5 million items a month, says it gets 100 million visits a month.

The e-commerce platform expects to turn profitable by the first half of 2017. The company has about 350,000 merchants on its platform.

ShopClues gets about 70 per cent of its traffic and transactions from mobile phones with repeat rates at 50 per cent. Its largest category is home and kitchen, followed by lifestyle. The company ships about 80,000 units per day.

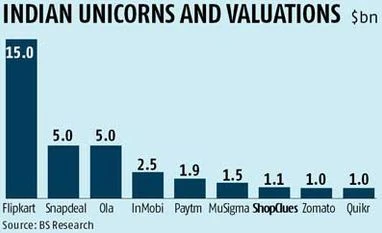

With ShopClues joining the unicorn club, the e-commerce battle is set to get fiercer in India as the sector is anticipating a year of major consolidations. The other Indian startups in the multi-billion dollar club include e-retailers Flipkart, Snapdeal and Paytm, online classifieds firm Quikr, cab aggregator Ola, food technology start-up Zomato, mobile ad network platform InMobi and analytics firm MuSigma.

“This investment will enable us to double our focus on digitising our merchants’ businesses so that they scale to fully leverage the opportunity online commerce provides them,” said Sanjay Sethi, CEO and co-founder, ShopClues.

The company was founded in 2011 by Silicon Valley-based entrepreneurs Sandeep Aggarwal, his wife Radhika Aggarwal, and Sanjay Sethi. With the current valuation, the company has become the first Indian unicorn led by a female entrepreneur.

“We are confident that our capital efficiency and execution will make this our last fund raise before we become profitable with the eventual IPO in 2017,” said Radhika Aggarwal, who is also the chief business officer at ShopClues.

The Gurgaon-based firm had raised $100 million in January 2015 from Tiger Global at a valuation of $500 million.

The capital raised in the fresh funds would be used to roll out new products to enable small and medium enterprises to digitise their business and to further entrench itself as the e-commerce operating system on the cloud, Shopclues stated. ShopClues will also strengthen its branding activities and acquire smaller companies.

“We are confident that ShopClues’ merchant-first mindset and solid management team will enable the company to expand its reach, especially in the Tier-II and Tier-III cities, bringing its unique value proposition to more consumers and merchants,” said GIC’s head of Asia Equities Research, Ravi Balasubramanian.

The four-year-old company’s gross merchandise value has grown four-fold since January 2015, when it raised $100 million from Tiger Global. ShopClues, which currently ships 3.5 million items a month, says it gets 100 million visits a month.

The e-commerce platform expects to turn profitable by the first half of 2017. The company has about 350,000 merchants on its platform.

ShopClues gets about 70 per cent of its traffic and transactions from mobile phones with repeat rates at 50 per cent. Its largest category is home and kitchen, followed by lifestyle. The company ships about 80,000 units per day.

“This investment will enable us to double our focus on digitising our merchants’ businesses so that they scale to fully leverage the opportunity online commerce provides them,” said Sanjay Sethi, CEO and co-founder, ShopClues.

The company was founded in 2011 by Silicon Valley-based entrepreneurs Sandeep Aggarwal, his wife Radhika Aggarwal, and Sanjay Sethi. With the current valuation, the company has become the first Indian unicorn led by a female entrepreneur.

“We are confident that our capital efficiency and execution will make this our last fund raise before we become profitable with the eventual IPO in 2017,” said Radhika Aggarwal, who is also the chief business officer at ShopClues.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jan 13 2016 | 12:46 AM IST