Slowing urban mart, FMCG cos to take premium route

Some FMCG majors looking to tap food segment which is growing faster in urban vis-à-vis rural India

)

Equity analysts tracking the fast-moving consumer goods (FMCG) sector expect signs of recovery in urban consumption from this quarter.

These companies have been seeing better growth in rural areas vis-à-vis urban India and some of them are already working on alternative strategies to ensure sustainable growth in the urban areas.

According to company sources and analysts, some have started work on building urban-specific product portfolios, including semi-premium and premium options. Some plan to tap the food segment, growing faster in urban than in rural India.

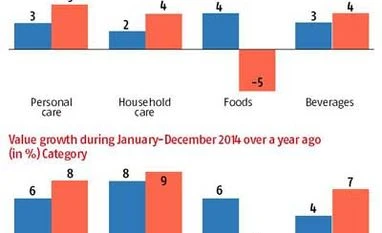

Financial results and data sourced from market research firm IMRB have shown FMCG companies had faster growth in the rural areas in calendar year 2014 across key product categories, both in volume and value, except for food. The latter was the only category that grew in urban India and fell in rural India.

“The consumption pattern in urban India is changing fast, with people moving towards the semi-premium and premium categories. Companies with urban focus have been doing well. But, the mass market players are suffering. The growth in rural areas is essentially territory growth. Per-store growth across India is not happening even in the rural areas,” said Alagu Balaraman, partner & managing director (India operations), CGN & Associates, a business performance consultancy.

In the immediate future, companies with a mass-market focus will be trading up with a premium and semi-premium portfolio. The ones with a premium portfolio will be focusing to expand their base, he added.

According to IMRB data, food as a category grew about four per cent in 2014 as against 2013, in urban India. While rural India had a five per cent decline. Growth was much faster across all other key categories — personal care, household care and beverages — in rural India during 2014, as compared with the previous year.

While rural India is an opportunity every FMCG company wants to capture, the slower growth in urban areas has emerged as a major concern they need to address. However, some companies, and analysts believe growth in urban India will see a recovery in the coming quarters, as low inflation and reducing interest rates will lead to a rise in discretionary spending.

Dabur, for instance, is not hopeful of the urban market growth recovering in the January-March quarter, the management had indicated at the announcement of its results. It and some others have started work on a possible alternative to counter this slowing growth in urban India.

Companies with mass-market products need to trade up and build a premium product portfolio to counter the urban slowdown, said Balaraman. Even companies with food products, a growing segment in urban areas, will have to build a presence in the high-end for better sustainability.

In a note, CRISIL points to rural India becoming a focus area for FMCG companies as government’s welfare policies (such as the rural jobs guarantee) have led to an increase in rural wages, fuelling consumption of discretionary goods. “This rising purchasing power of rural households has meant rural FMCG consumption growth outpaced urban growth. FMCG companies anticipated this correctly and expanded their rural reach significantly, by increasing distribution channels over the past five years,” it said.

Godrej Consumer Products, for instance, reported 16 per cent growth in rural areas in the October-December quarter, against 13 per cent growth in urban India. However, the gap between the rural and urban growth rate has come down in the past few quarters for Godrej because of its premium portfolio and urban focus.

“Our push into rural will be there. We continue to expand our direct reach. We will also push more premium products across our three categories of operation. We will accelerate the pace of our launches and most of these will be in the premium parts of the home and personal care market,” said Vivek Gambhir, managing director.

Hindustan Unilever, India's largest FMCG company, depends on home and personal care for 80 per cent of its revenue.

For these two categories, rural consumption was better than urban, both in terms of value and volume, in the January-December 2014 period.

Foods account for 70 per cent of ITC's non-cigarette FMCG business. Analysts tracking the market say the company would have benefited from urban consumption growth in this segment, as a large part of packaged foods continues to find traction in urban markets. ITC does not give a break-up of its urban-rural skew in foods.

Marico chairman Harsh Mariwala had also said 10-15 per cent of the company’s revenue comes from value-added products. “I would like this number to go up substantially,” he'd added. Marico wants to increase this number as it attempts to reduce dependence on coconut oil, prone to commodity price fluctuations and intense competition.

Kolkata-based Emami is also working on expanding its premium portfolio through acquisitions and organically.

These companies have been seeing better growth in rural areas vis-à-vis urban India and some of them are already working on alternative strategies to ensure sustainable growth in the urban areas.

According to company sources and analysts, some have started work on building urban-specific product portfolios, including semi-premium and premium options. Some plan to tap the food segment, growing faster in urban than in rural India.

Financial results and data sourced from market research firm IMRB have shown FMCG companies had faster growth in the rural areas in calendar year 2014 across key product categories, both in volume and value, except for food. The latter was the only category that grew in urban India and fell in rural India.

“The consumption pattern in urban India is changing fast, with people moving towards the semi-premium and premium categories. Companies with urban focus have been doing well. But, the mass market players are suffering. The growth in rural areas is essentially territory growth. Per-store growth across India is not happening even in the rural areas,” said Alagu Balaraman, partner & managing director (India operations), CGN & Associates, a business performance consultancy.

In the immediate future, companies with a mass-market focus will be trading up with a premium and semi-premium portfolio. The ones with a premium portfolio will be focusing to expand their base, he added.

While rural India is an opportunity every FMCG company wants to capture, the slower growth in urban areas has emerged as a major concern they need to address. However, some companies, and analysts believe growth in urban India will see a recovery in the coming quarters, as low inflation and reducing interest rates will lead to a rise in discretionary spending.

Dabur, for instance, is not hopeful of the urban market growth recovering in the January-March quarter, the management had indicated at the announcement of its results. It and some others have started work on a possible alternative to counter this slowing growth in urban India.

Companies with mass-market products need to trade up and build a premium product portfolio to counter the urban slowdown, said Balaraman. Even companies with food products, a growing segment in urban areas, will have to build a presence in the high-end for better sustainability.

In a note, CRISIL points to rural India becoming a focus area for FMCG companies as government’s welfare policies (such as the rural jobs guarantee) have led to an increase in rural wages, fuelling consumption of discretionary goods. “This rising purchasing power of rural households has meant rural FMCG consumption growth outpaced urban growth. FMCG companies anticipated this correctly and expanded their rural reach significantly, by increasing distribution channels over the past five years,” it said.

Godrej Consumer Products, for instance, reported 16 per cent growth in rural areas in the October-December quarter, against 13 per cent growth in urban India. However, the gap between the rural and urban growth rate has come down in the past few quarters for Godrej because of its premium portfolio and urban focus.

“Our push into rural will be there. We continue to expand our direct reach. We will also push more premium products across our three categories of operation. We will accelerate the pace of our launches and most of these will be in the premium parts of the home and personal care market,” said Vivek Gambhir, managing director.

Hindustan Unilever, India's largest FMCG company, depends on home and personal care for 80 per cent of its revenue.

For these two categories, rural consumption was better than urban, both in terms of value and volume, in the January-December 2014 period.

Foods account for 70 per cent of ITC's non-cigarette FMCG business. Analysts tracking the market say the company would have benefited from urban consumption growth in this segment, as a large part of packaged foods continues to find traction in urban markets. ITC does not give a break-up of its urban-rural skew in foods.

Marico chairman Harsh Mariwala had also said 10-15 per cent of the company’s revenue comes from value-added products. “I would like this number to go up substantially,” he'd added. Marico wants to increase this number as it attempts to reduce dependence on coconut oil, prone to commodity price fluctuations and intense competition.

Kolkata-based Emami is also working on expanding its premium portfolio through acquisitions and organically.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Feb 17 2015 | 12:30 AM IST