Strong prospects for Hindalco

Hindalco produced four per cent more aluminium and two per cent more alumina on a y-o-y basis

)

premium

Source: Motilal Oswal Securities

After a robust show by its US subsidiary Novelis, Hindalco's standalone performance too was impressive. The June quarter had posed some challenges in terms of correction in base metal prices on a sequential basis and also goods and services tax-led destocking. The company beat consensus estimates on revenues and operating profits levels despite these negatives.

Average copper prices at about $5,662 a tonne on the London Metal Exchange (LME) was 3 per cent down sequentially. Aluminium prices per tonne remained volatile in the range $1,960-1,855 during the quarter and have shot up to $2,040 levels in August. Thus, while some softness in performance on a sequential basis is understandable, on a year-on-year (y-o-y) basis higher LME prices for both metals (up 20-21 per cent) and rising volumes helped.

Hindalco produced four per cent more aluminium and two per cent more alumina on a y-o-y basis. Copper had seen capacity shutdown in June 2016 quarter resulting in 67 per cent y-o-y increase in cathode production and 51 per cent increase in revenues to Rs 5,403 crore, while aluminium revenue grew nine percent to Rs 5,008 crore.

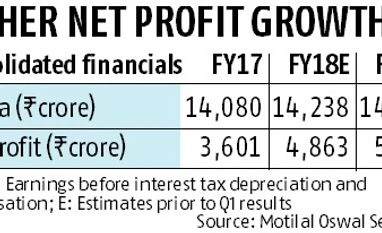

All this led to a 27 per cent increase in revenues to Rs 10,663 crore. Copper contributes about 38 per cent to earnings before interest, tax, depreciation and amortisation (Ebidta). Aluminium too saw comparable Ebitda despite a 47 per cent increase in raw material costs. Nevertheless, overall Ebitda grew four per cent to Rs 1,404 crore beating consensus estimates of Rs 1,245 crore.

Average copper prices at about $5,662 a tonne on the London Metal Exchange (LME) was 3 per cent down sequentially. Aluminium prices per tonne remained volatile in the range $1,960-1,855 during the quarter and have shot up to $2,040 levels in August. Thus, while some softness in performance on a sequential basis is understandable, on a year-on-year (y-o-y) basis higher LME prices for both metals (up 20-21 per cent) and rising volumes helped.

Hindalco produced four per cent more aluminium and two per cent more alumina on a y-o-y basis. Copper had seen capacity shutdown in June 2016 quarter resulting in 67 per cent y-o-y increase in cathode production and 51 per cent increase in revenues to Rs 5,403 crore, while aluminium revenue grew nine percent to Rs 5,008 crore.

All this led to a 27 per cent increase in revenues to Rs 10,663 crore. Copper contributes about 38 per cent to earnings before interest, tax, depreciation and amortisation (Ebidta). Aluminium too saw comparable Ebitda despite a 47 per cent increase in raw material costs. Nevertheless, overall Ebitda grew four per cent to Rs 1,404 crore beating consensus estimates of Rs 1,245 crore.

Source: Motilal Oswal Securities