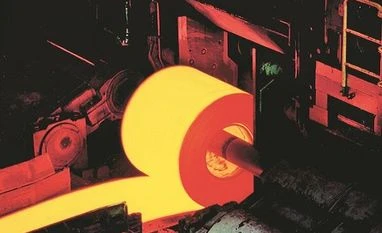

AM/NS India, a joint venture between the world’s leading steel maker ArcelorMittal and Japan’s Nippon Steel, has plans of ramping up capacity to 30 million tonnes (mt) at an investment of Rs 85,000 crore. The current steelmaking capacity at Hazira in Gujarat is 9 mt; it will be ramped up to 14 mt in the next three years and later to 18 mt. The two phases of expansion are expected to cost Rs 35,000 crore. An ongoing capital expenditure (capex) of Rs 7,000 crore for debottlenecking is underway. In addition, AM/NS India has signed a memorandum of understanding for a new 12-mt integrated plant in Odisha, at an investment of Rs 50,000 crore.

“Though the average capacity utilisation of Corporate India is still low, there are few companies — mainly in ports and renewables — which have begun the groundwork to set up additional capacity. The ArcelorMittal plant, for instance, is currently producing steel at 100 per cent capacity,” says an analyst with a foreign brokerage.

Among the new-gen companies, Ola Electric is set to lift off its electric scooter production after starting work on a brand new plant just four months ago. Rising sales and profits in the March quarter of 2020-21 (FY21) is giving confidence to companies to restart work on expansion plans.

The recovery process for Indian corporates started from the quarter ended December 2020 as demand from customers rose.

“Barring the impressive top-line and bottom-line numbers, a cardinal point about this (March 2021) quarter is that there has been a broad-based increase in the operating expenses of the companies on the back of a global rally in commodity prices and ramping up of production activities,” says a report by rating firm, CARE Ratings.

Iron and steel, along with auto and auto ancillary, have been the best-performing industries, with net sales growth of almost 50 per cent in the March quarter of FY21.

As capacity utilisation of these industries went up, top companies are now revisiting their plans.

Aditya Birla Group’s Hindalco Industries is planning to invest Rs 3,000 crore over the next two years in downstream projects to increase contribution of value-added products. Company officials said the investment in increasing flat-rolled product capacity at Hirakud itself will entail an investment of Rs 2,700 crore; the rest of the capex will be towards producing alumina specialty chemicals.

Another group company UltraTech Cement has already approved an investment of Rs 5,477 crore for raising capacity by 12.8 mt, which will be a combination of both brownfield and greenfield expansions.

Sajjan Jindal-led JSW Steel plans to spend Rs 47,457 crore towards capex in the next three years for adding 5 million tonnes per annum (mtpa) steelmaking capacity at Vijayanagar in Karnataka, and building a mining infrastructure in Odisha. The new projects will cost the company Rs 25,115 crore, while the ongoing capex, including doubling of capacity at Dolvi in Maharashtra to 10 mtpa, will require Rs 22,342 crore.

Another group company JSW Energy is pursuing a growth strategy to expand from 4.6 gigawatt (Gw) to 10 Gw by 2024-25, and 20 Gw by 2029-30, with the entire capacity addition being via renewables. Of this, 2.5 Gw is currently under construction. It plans to sign a power purchase agreement in the next quarter.

Naveen Jindal-led Jindal Steel & Power plans to double capacity to 12 mt at Angul and Raigad over the next three years. The capex of about Rs 17,000-18,000 crore for the expansion will be done via internal accruals.

Tata Steel has planned a capex of Rs 11,000 crore for 2021-22, of which around 70 per cent has been allocated to the expansion of its India operations.

Adani Group has also planned a massive expansion plan in its ports and logistics business and targets to emerge as the world’s largest private port company by 2030.

For the Indian information technology (IT) services sector, the biggest cost is employees. Hence, the capex in the past was all about expanding capacity, in terms of physical infrastructure and investments in technology (tech) upgrades.

India’s largest IT services player, Tata Consultancy Services’ (TCS’) capex ratio to total revenue was 2 per cent in 2019-20 (FY20) and 1.9 per cent in FY21. “Capex related to tech upgrades will accelerate. The focus will be on refreshing some of the IT hardware. The overall capex will be similar to FY20’s,” said V Ramakrishnan, chief financial officer (CFO), TCS, in a conference call after the March quarter results.

Infosys is also planning to ramp up capex, but it will still be below pre-pandemic levels, said Nilanjan Roy, CFO, Infosys, soon after declaring the March quarter results.

With inputs from Shivani Shinde

)