Budget 2018: After all the hype, Jaitley delivers fairly balanced outcome

Jaitley's Budget 2018 speech was more on the expenditure side, with higher allocations being announced for infrastructure and social services

)

premium

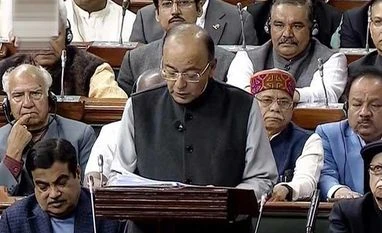

Budget 2018 LIVE: Finance Minister Arun Jaitley

Budget 2018 came out fairly balanced, with disappointments on the income tax and LTCG tax fronts for households and markets, respectively. Further, the government's projections on growth appear to be reasonable. Overall, the Budget was nowhere near as radical as the hype around it suggested.

After the hype created around Budget 2018 considering it was to be the last before elections in 2019, the final outcome has been fairly balanced -- with nothing really radical and with the goal being to move along the FRBM path. A higher deficit ratio of 3.5 per cent for FY18 has given scope for lowering the same to 3.3 per cent in FY19. The assumption of 11.5 per cent growth in GDP based on 7.2-7.5 per cent real GDP and four per cent inflation looks reasonable, with an upward bias in case inflation is higher.

After the hype created around Budget 2018 considering it was to be the last before elections in 2019, the final outcome has been fairly balanced -- with nothing really radical and with the goal being to move along the FRBM path. A higher deficit ratio of 3.5 per cent for FY18 has given scope for lowering the same to 3.3 per cent in FY19. The assumption of 11.5 per cent growth in GDP based on 7.2-7.5 per cent real GDP and four per cent inflation looks reasonable, with an upward bias in case inflation is higher.