Companies feeling puzzled as states proceed with old, new way bills

With the postponement of the centralised e-way bill system through the GST Network, states are bringing back their old systems

)

premium

A week after the electronic-way (e-way) bill was deferred on the day of its country-wide launch, companies are grappling with inconsistency among states over its rollout.

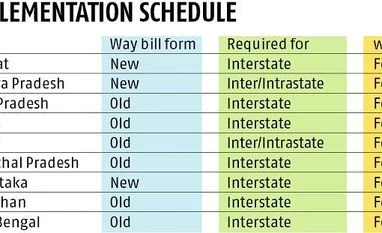

Several states have notified different dates for implementation of the way bill in the old and new formats to track movement of goods across and within states, causing confusion in industry.

Gujarat has notified February 21 as the date for introducing the inter-state e-way bill in the new format, while Andhra Pradesh has notified e-way bills will be applicable from February 8.

Assam, Himachal Pradesh and West Bengal have said the old way bill will continue for inter-state movement of consignments. Uttar Pradesh has notified February 10 for bringing back the old way bill, while Rajasthan has notified it for inter-state movement for 33 commodities.

Bihar has announced a Rs 50,000 threshold for inter-state goods movement and Rs 200,000 for intra-state movement for continuation under the old way bill.

Companies in industries like fast-moving consumer goods, pharmaceuticals and consumer durables are apprehensive because their consignments pass through several states and rules differ in each of them.

The goods and services tax (GST) revenue slowdown had prompted the GST Council to advance the rollout of the e-way bill for inter-state movement of goods to February 1 and for intra-state carriage the date is June 1.

The states had discontinued their old way bill mechanism on February 1, the day of the launch of the e-way bill. With the postponement of the centralised e-way bill system through the GST Network, states are bringing back their old systems. However, there is apprehension and anxiety across sectors.

Several states have notified different dates for implementation of the way bill in the old and new formats to track movement of goods across and within states, causing confusion in industry.

Gujarat has notified February 21 as the date for introducing the inter-state e-way bill in the new format, while Andhra Pradesh has notified e-way bills will be applicable from February 8.

Assam, Himachal Pradesh and West Bengal have said the old way bill will continue for inter-state movement of consignments. Uttar Pradesh has notified February 10 for bringing back the old way bill, while Rajasthan has notified it for inter-state movement for 33 commodities.

Bihar has announced a Rs 50,000 threshold for inter-state goods movement and Rs 200,000 for intra-state movement for continuation under the old way bill.

Companies in industries like fast-moving consumer goods, pharmaceuticals and consumer durables are apprehensive because their consignments pass through several states and rules differ in each of them.

The goods and services tax (GST) revenue slowdown had prompted the GST Council to advance the rollout of the e-way bill for inter-state movement of goods to February 1 and for intra-state carriage the date is June 1.

The states had discontinued their old way bill mechanism on February 1, the day of the launch of the e-way bill. With the postponement of the centralised e-way bill system through the GST Network, states are bringing back their old systems. However, there is apprehension and anxiety across sectors.