RBI lifts interest cap on microfinance institutions, bans usurious rates

Borrower cannot be charged any amount not been explicitly mentioned in a factsheet, says regulator.

)

premium

The RBI will continue checking the rates microfinance institutions charge.

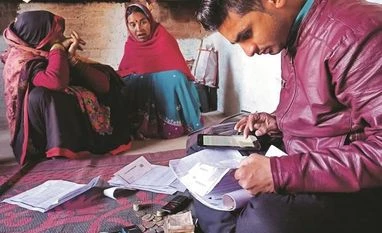

The Reserve Bank of India (RBI) on Monday released its final guidelines for microfinance loans, lifting an interest cap and allowing companies to have a board-approved policy to price for such lending.

The RBI will continue checking that microfinance institutions do not charge usurious rates. The regulator said each entity has to disclose pricing related information to borrowers in a standardised simplified factsheet. A borrower cannot be charged any amount that has not been explicitly mentioned in the factsheet.

The RBI will continue checking that microfinance institutions do not charge usurious rates. The regulator said each entity has to disclose pricing related information to borrowers in a standardised simplified factsheet. A borrower cannot be charged any amount that has not been explicitly mentioned in the factsheet.