RBI sells dollars to beef up rupee, bond yields inch up

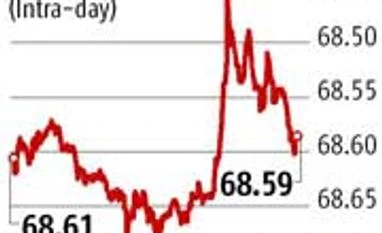

The rupee closed at 68.59, up from its previous close of 68.61 a dollar

)

The rupee on Tuesday strengthened after the Reserve Bank of India (RBI) sold dollars in the market but the mood in the bond market remained bearish.

The rupee closed at 68.59, up from its previous close of 68.61 a dollar. Still, it is the second worst-performing major currency in Asia this calendar year. In fact, currencies of emerging markets are on the rise, whereas the rupee is falling.

The rupee's fall so far this calendar year has been 3.55 per cent, whereas the South Korean won has fallen 4.56 per cent. Part of the reason for the sustained, even if gradual, fall was that the central bank has not been as aggressive in its intervention as it used to be earlier, said currency dealers.

However, the central bank has stepped in after the local currency was seen trading at its record-low levels in the non-deliverable forwards (NDF) market overseas. In that market, traders are betting that the rupee would cross 68.90 a dollar in a month's time.

In a note to clients, ICICI Bank Global Markets said the Chinese yuan's depreciation and the dollar's strength would weigh on the rupee.

"We maintain gradual depreciation bias for the rupee and expect it to trade in the range of 68-70 in the near term and close the year FY17 at Rs 72 levels," the report said, adding, sharper devaluation in the yuan and "any unanticipated policy moves by the Federal Reserve remain the tail risk event for the domestic currency".

However, RBI has enough ammunition to address excessive volatility in the foreign exchange market, ICICI Bank said. RBI in the past few days have been selling dollars, said Aman Mahna, currency dealer with First Rand Bank.

But stock market weakness was weighing on the rupee, said Satyajit Kanjilal, managing director of Forexserve.

Government bonds

The cut-off yield for state government bonds maturing in 10 years topped 8.88 per cent on Tuesday, more than 100 basis points over the 10-year benchmark government security, indicating saturated demand for bonds in the market. The cut-off yields in state development loans (SDL) pushed up government yields too, with the 10-year benchmark bond yield closing at 7.82 per cent, from 7.77 per cent on Monday.

With the latest cut off in the SDL, the yield gap between the policy repo rate and SDLs have widened beyond 200 basis points and this would put pressure on the government borrowing programme in the new financial year, said bond dealers.

India Ratings and Research said high yields on state loans would likely raise borrowing costs even in the corporate debt market.

"At elevated yields, incremental preference for sovereign or quasi-sovereign bonds could potentially cannibalise demand for corporate debt, thus driving up interest cost for corporates," the rating agency said.

On Tuesday, 21 states raised Rs 21,440 crore, the highest they have ever raised in a single issue, while spreads compared to the 10 year G-sec widened due to heavy supply. The spreads over equivalent maturity government papers were at 80-105 basis points, sharply higher than the average spread of 39-45 basis points at the start of 2016.

The rupee closed at 68.59, up from its previous close of 68.61 a dollar. Still, it is the second worst-performing major currency in Asia this calendar year. In fact, currencies of emerging markets are on the rise, whereas the rupee is falling.

Read more from our special coverage on "RBI"

The rupee's fall so far this calendar year has been 3.55 per cent, whereas the South Korean won has fallen 4.56 per cent. Part of the reason for the sustained, even if gradual, fall was that the central bank has not been as aggressive in its intervention as it used to be earlier, said currency dealers.

However, the central bank has stepped in after the local currency was seen trading at its record-low levels in the non-deliverable forwards (NDF) market overseas. In that market, traders are betting that the rupee would cross 68.90 a dollar in a month's time.

In a note to clients, ICICI Bank Global Markets said the Chinese yuan's depreciation and the dollar's strength would weigh on the rupee.

However, RBI has enough ammunition to address excessive volatility in the foreign exchange market, ICICI Bank said. RBI in the past few days have been selling dollars, said Aman Mahna, currency dealer with First Rand Bank.

But stock market weakness was weighing on the rupee, said Satyajit Kanjilal, managing director of Forexserve.

Government bonds

The cut-off yield for state government bonds maturing in 10 years topped 8.88 per cent on Tuesday, more than 100 basis points over the 10-year benchmark government security, indicating saturated demand for bonds in the market. The cut-off yields in state development loans (SDL) pushed up government yields too, with the 10-year benchmark bond yield closing at 7.82 per cent, from 7.77 per cent on Monday.

With the latest cut off in the SDL, the yield gap between the policy repo rate and SDLs have widened beyond 200 basis points and this would put pressure on the government borrowing programme in the new financial year, said bond dealers.

India Ratings and Research said high yields on state loans would likely raise borrowing costs even in the corporate debt market.

"At elevated yields, incremental preference for sovereign or quasi-sovereign bonds could potentially cannibalise demand for corporate debt, thus driving up interest cost for corporates," the rating agency said.

On Tuesday, 21 states raised Rs 21,440 crore, the highest they have ever raised in a single issue, while spreads compared to the 10 year G-sec widened due to heavy supply. The spreads over equivalent maturity government papers were at 80-105 basis points, sharply higher than the average spread of 39-45 basis points at the start of 2016.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Feb 23 2016 | 10:52 PM IST