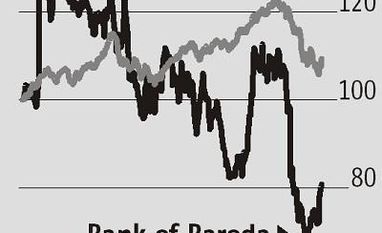

Bank of Baroda's strong Q2 results instills confidence in investors

Improvement in asset quality led by strong operational growth are key positives for shareholders

)

premium

The September quarter (Q2) results of Bank of Baroda (BoB) is among the best in recent times. PS Jayakumar, the lender's MD & CEO since October 2015, and his team have walked the talk on improving the bank’s asset quality. While most government-owned banks (PSU Banks) have seen this metric bettering in Q2, BoB outperformed the pack with 20.6 per cent year-on-year reduction in bad-loan provisioning costs and slippages of Rs 22.8 billion coming in at seven-quarter low. Total provisioning cost stood at Rs 24 billion, up 4.3 per cent year-on-year, due to the impact of mark-to-market (investment) losses.