FPI ownership in Indian equities hits a life-time high

They own 27.5% in top 75 listed firms; investments bounce back after falling two straight quarters

)

premium

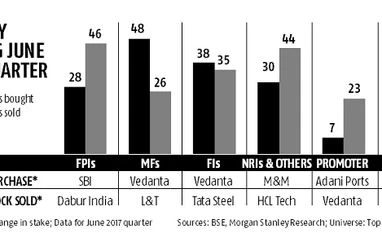

The total ownership of foreign portfolio investors (FPIs) in Indian equities hit a record high during the quarter ending June (Q1) as overseas funds continued to invest aggressively. In total, FPIs own 27.5 per cent in the top 75 listed companies, data compiled by Morgan Stanley showed. The FPI ownership increased 59 basis points during the June quarter when these funds net purchased equities worth Rs 11,340 crore ($1.8 billion) from the Indian markets.

The previous peak in terms of FPI shareholding was in September 2016, when foreign investors owned 27.3 per cent in the top 75 Indian listed companies. But, in the wake of demonetisation, FPIs repositioned their portfolios after the September 2016 high. Hence, FPI ownership witnessed a fall in the two subsequent quarters.

“During the quarter ended June 2017, the average sector position for FPIs was flat, while portfolio churn inched up after the fall in the previous two quarters. However, FPIs appear to be overweight in only two out of the 10 MSCI sectors: Financials and Utilities,” said Ridham Desai, managing director, Morgan Stanley in a note.

On the other, holdings of domestic mutual funds (MFs) increased for the 12th quarter in a row because of the impressive inflows received by various systematic investment plans (SIPs). At the end of Q1, MFs owned 5.7 per cent stake in the top 75 listed companies, up 44 basis points (bps) quarter-on-quarter.

The previous peak in terms of FPI shareholding was in September 2016, when foreign investors owned 27.3 per cent in the top 75 Indian listed companies. But, in the wake of demonetisation, FPIs repositioned their portfolios after the September 2016 high. Hence, FPI ownership witnessed a fall in the two subsequent quarters.

“During the quarter ended June 2017, the average sector position for FPIs was flat, while portfolio churn inched up after the fall in the previous two quarters. However, FPIs appear to be overweight in only two out of the 10 MSCI sectors: Financials and Utilities,” said Ridham Desai, managing director, Morgan Stanley in a note.

On the other, holdings of domestic mutual funds (MFs) increased for the 12th quarter in a row because of the impressive inflows received by various systematic investment plans (SIPs). At the end of Q1, MFs owned 5.7 per cent stake in the top 75 listed companies, up 44 basis points (bps) quarter-on-quarter.