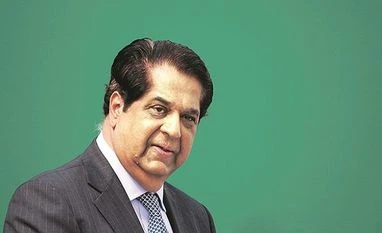

K V Kamath (pictured) at the Reset 2020 conference, organised by ICICI Asset Management Company (AMC), for its distributors and investors.

“Money managers will have to identify companies that drive growth in this new reset. That is likely going to be a blend of new and old companies. The markets overall will be driven by these new stars,” said Kamath, founder and former MD and CEO of ICICI Bank.

He pointed out every decade the number of firms falling out of the top league in the markets has been more than those staying in it.

On the recent disruptions in the economy, Kamath said some sectors will continue to be in pain. “Construction, real estate in some cities, hotel, travel and tourism... the jury is out. We don’t know at what point of time these sectors will come back,” he said.

“Players in the financial system have pain at various levels. We will need to look at the numbers that come out from these institutions and the central bank to understand what is happening in that space,” he added.

Kamath underlined that some businesses will need balance sheet restructuring. “We were having a meeting with the heads of all development banks in the world. Almost everybody said that they expect massive balance-sheet restructuring in the countries they operate in. Not sure whether India will need massive balance-sheet restructuring, but restructuring might be required to some extent,” he said.

He said low interest rates in India is a positive, and the link between inflation and interest rates has been long broken.

)