Domestic institutional investors continued to be buyers. But FPIs (foreign portfolio investors) have sold heavily through October, dumping over Rs 210 billion of equity and over Rs 148 billion of debt. Bond market yields are elevated. The rupee continues to look weak. Retail investors have been direct equity sellers but they continue to subscribe to equity mutual funds.

Corporate results have not been very strong so far. Expectations are not too high however. Crude prices have spiked up, as the US will look to tighten sanctions on Iran in November. The US-China trade wars, the murder of Jamal Khashoggi, fears of Brexit, etc, have also hurt sentiment.

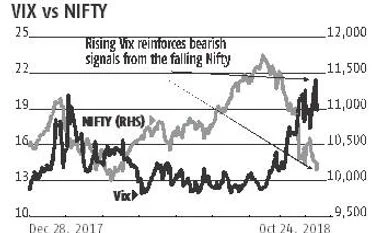

The Nifty hit an all-time high of 11,760 in late August and it has since retracted to lows in the region of 10,100. The 200-DMA is currently trending at 10,750, so it has been absolutely broken. While the Nifty has hit successively falling lows, the Vix has spiked sharply, indicating fear is very much back in the market, along with higher volatility.

The downtrend has lasted around seven weeks and there has been a 13 per cent retraction off the top. This settlement has seen losses of 6.9 per cent. If there's a rebound, the 200-DMA will provide resistance in the 10,700-10,800 zone. To indicate bullishness, the index would have to move above the 200-DMA and ideally, beat 11,760. On the downside, a fall below 10,000, could mean a deep dive till 9,500-9,600 as the minimum target.

The Bank Nifty is down below 25,100 and it has also broken well below its 200-DMA. A long November 29, 24,000p (332) and a long 26,000c (320) can be offset with a short November 6, 24,000p (125), short 26,000c (105). This could fetch an excellent return with breakevens approximately at 23,550, 26,450.

The Nifty is at 10,225. A long November 10,500c (128), short 10,600c (90) costs 38, and pays a maximum of 62. A long November 9,900p (116), short 9,800p (94) costs 22, and pays a maximum of 78. In the short-term, a trader can sell the short 10,400c (173), short 10,000p (141) intended to reverse the position by Monday. This could provide quick gains, if the index doesn't move outside that 10,000-10,400 range in the next three sessions.

)