Merger with SBI strong catalyst for SBT and SBBJ

While timing is uncertain, eventual merger likely to boost stocks that are looked upon by experts as key dividend yield plays as well

)

Re-surfacing of the buzz regarding consolidation of Indian public sector banks in recent times merits a re-look at the merger of State Bank of India’s (SBI) subsidiaries with itself. The consolidation will catapult SBI as one of the world’s top 10 largest banks. SBI has completed merger of two of its subsidiaries, namely State Bank of Indore and State Bank of Saurashtra earlier and now has five remaining subsidiaries.

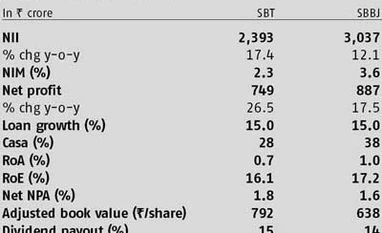

Of these, three are listed i.e. State Bank of Travancore (SBT), State Bank of Bikaner and Jaipur (SBBJ) and and State Bank of Mysore. Notably, these banks are trading at a sharp discount vis-à-vis their own historical average valuations as well as those of comparable peers such as Bank of Maharashtra, Andhra Bank, Dena Bank, amongst others. At 0.7 times FY14 estimated adjusted book value, each of these banks is trading at about 30 per cent discount to their average valuations of one time one-year forward price/adjusted book value. While merger with SBI will be a strong re-rating catalyst for these banks, historical data suggests that these stocks have gained handsomely even during past mergers of State Bank of Indore and State Bank of Saurashtra with SBI. Analysts, thus, remain positive on these stocks.

“Assuming implied valuation of 0.7 times book value for the last merger (State Bank of Indore), both SBT and SBBJ have significant upside potential (40 per cent from current levels) if the merger were to happen in FY15. Though timing the merger is difficult, we believe the merger ratio of SBT and SBBJ would be higher since these banks have 25 per cent stake held by minority investors versus two per cent for State Bank of Indore,” believe analysts at Axis Capital.

Both these banks have strong market share in their states and enjoy full support from their parent in terms of capital, technology, consortium lending with SBI and so on.

Cross-selling of SBI products such as mutual fund schemes and life insurance schemes has enabled them to have strong fee income ranging between 20-26 per cent of their total income. While analysts expect the loan and deposit growth to be strong at 14-15 per cent going forward, restructured assets remain a key monitorable- especially for SBBJ. While SBT has reasonable levels of re-structured assets (three per cent of net advances), the metric stands at seven per cent for SBBJ. The asset quality concerns though are in sync with slowing macro economy. Further, experts believe these stocks are also strong dividend yield plays. While the dividend yields for these banks is likely to be between three and four per cent in FY13, analysts expect this figure to increase up over the next couple of years and, hence, remain positive on these.

Of these, three are listed i.e. State Bank of Travancore (SBT), State Bank of Bikaner and Jaipur (SBBJ) and and State Bank of Mysore. Notably, these banks are trading at a sharp discount vis-à-vis their own historical average valuations as well as those of comparable peers such as Bank of Maharashtra, Andhra Bank, Dena Bank, amongst others. At 0.7 times FY14 estimated adjusted book value, each of these banks is trading at about 30 per cent discount to their average valuations of one time one-year forward price/adjusted book value. While merger with SBI will be a strong re-rating catalyst for these banks, historical data suggests that these stocks have gained handsomely even during past mergers of State Bank of Indore and State Bank of Saurashtra with SBI. Analysts, thus, remain positive on these stocks.

“Assuming implied valuation of 0.7 times book value for the last merger (State Bank of Indore), both SBT and SBBJ have significant upside potential (40 per cent from current levels) if the merger were to happen in FY15. Though timing the merger is difficult, we believe the merger ratio of SBT and SBBJ would be higher since these banks have 25 per cent stake held by minority investors versus two per cent for State Bank of Indore,” believe analysts at Axis Capital.

Both these banks have strong market share in their states and enjoy full support from their parent in terms of capital, technology, consortium lending with SBI and so on.

Cross-selling of SBI products such as mutual fund schemes and life insurance schemes has enabled them to have strong fee income ranging between 20-26 per cent of their total income. While analysts expect the loan and deposit growth to be strong at 14-15 per cent going forward, restructured assets remain a key monitorable- especially for SBBJ. While SBT has reasonable levels of re-structured assets (three per cent of net advances), the metric stands at seven per cent for SBBJ. The asset quality concerns though are in sync with slowing macro economy. Further, experts believe these stocks are also strong dividend yield plays. While the dividend yields for these banks is likely to be between three and four per cent in FY13, analysts expect this figure to increase up over the next couple of years and, hence, remain positive on these.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Mar 26 2013 | 10:40 PM IST