Sebi mulls dual-class structure to prevent hostile takeovers

Start-up firms will be allowed to issue shares with superior, fractional voting rights

)

premium

sebi

3 min read Last Updated : Mar 21 2019 | 2:44 AM IST

The Securities and Exchange Board of India (Sebi) on Wednesday issued a draft framework to allow domestic companies to issue shares with differential voting rights (DVRs).

If approved, companies will be allowed to issue shares with either fractional or superior voting rights.

If approved, companies will be allowed to issue shares with either fractional or superior voting rights.

The move will particularly help new-age companies and promoters as they will be able to retain decision-making powers without diluting too much control. It will also act as a mechanism to stave off hostile takeovers, which have become a concern among companies with low-promoter holding.

The current regulatory framework doesn’t permit DVRs with higher or superior voting rights. Sebi has proposed dual-class share framework with superior voting rights, where a share will have higher voting power than an ordinary share. This, however, will be restricted only to unlisted companies. Listed companies will be permitted to issue shares with inferior voting rights, where a share will carry a fraction of voting power compared to an ordinary share. Besides voting power, these shares could carry other rights like higher dividends.

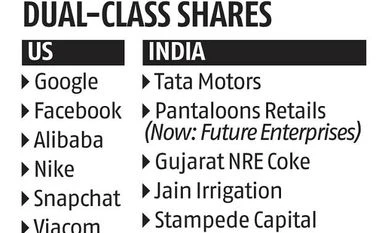

Such structures are common globally with companies such as Facebook, Alibaba and Snapchat issuing dual-class shares. Snapchat, in particular, has issued so-called Class C shares held by promoters to retain 90 per cent voting power.

In India, five companies such including Tata Motors, erstwhile Pantaloons Retails and Gujarat NRE Coke had issued shares with DVRs. In 2009, Sebi had directed stock exchanges to prohibit use of DVRs.

The proposed new framework is mainly aimed at new technology firms, which typically see high growth but burn a lot of cash and thus are required to raise capital at frequent intervals.

“Raising equity on a periodic basis leads to dilution of founder stake, which can be effectively addressed through use of DVRs as a mode of capital raising,” Sebi said in the discussion paper. “These (new-age) firms, continuously require to grow only through equity, which dilutes the founder’s stake, thereby diluting control. In such cases, retaining the founder’s interest and control in the business is of great value to all shareholders.”

Sebi has proposed to allow unlisted companies to issue superior right (SR) shares. Also, companies that issued SR shares will be allowed to come out with an initial public offering (IPO). Sebi has, however, said that only ordinary shares can be issued in the IPO. Also, post listing, further issue of SR shares in any form will not be permitted. Also, there will be bar on pledging or creating third-party interest in SR shares. Further, SR shares will have to be treated on a par with the ordinary equity shares in every respect except in the case of voting on resolutions. The maximum voting power on SR shares is proposed to be 10:1 – 10 votes for every SR share held.

More importantly, post-listing, SR shares will be treated on a par with ordinary shares in cases such as appointment or removal of independent directors or voluntary winding up of the company.

Experts said the provisions aimed at safeguarding the interests of minority shareholders once the company becomes public. The SR shares will come with a “sunset clause”, where they will be converted into ordinary shares after five years of their issuance.

Meanwhile, Sebi has proposed a different framework for issue of fractional right (FR) shares. Sebi said any company listed for more than a year can issue FR shares by way of rights issue, bonus issue or a follow-on public offering or FPO. Such shares will come with lower voting rights but higher dividends.