Since the presentation of the Budget earlier this month, the S&P BSE Sensex and the Nifty50 have lost around five per cent each. In comparison, the S&P BSE Smallcap index has lost 8.5 per cent. The index hit an intra-day low of 13,089 points, its lowest level since February 1, 2017, on the BSE. From the recent high on April 16, 2019, the smallcap index has tanked 13 per cent, as against 10 per cent fall in the midcap and three per cent cut in the benchmark index.

Going ahead, analysts expect the markets to correct further from the current levels, which they say, will be a good time to buy small-caps, albeit selectively.

"Small-caps are nearing reasonable valuations and one can look to buy in a staggered manner over the next few months for the long-term. Many good stocks have corrected over 50 per cent from their peaks. Markets can see the last leg of correction over the next few months, which I expect will be brutal. The small-caps should start bottoming out in the three-four months from now," says A K Prabhakar, head of research at IDBI Capital.

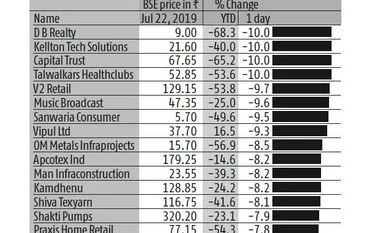

Among stocks, Capacite Infraprojects, VIP Industries, Talwalkars Healthclubs, V2 Retail, Shiva Texyarn, Vardhman Textiles, Ultramarine & Pigments, HEG, Just Dial, Shakti Pumps and Mahindra CIE Automotive were among that tanked between six per cent and 11 per cent on the BSE on Monday.

ALSO READ: Unrealistic to expect any major boost from the Budget itself: Pratik Gupta

As many as 217 stocks from the smallcap index hit their respective 52-week lows. Of these, Cox & Kings, Eris Lifesciences, Eros International Media, Khadim, MTNL, Pratap Snacks, Quick Heal Technologies and S Chand & Company were among the 28 counters that touched respective low levels since their listing.

G Chokkalingam, founder and managing director at Equinomics Research, too, believes the time is ripe for putting minimum 50 per cent of allocation into the small-and mid-cap segment.

"Collectively, all stocks other than 15 large-cap index stocks have lost around Rs 24-trillion (as on July 18, 2019) since January 2018 peak. Value erosion in the broader markets has been too steep. Investors may have to wait for anywhere between 6-18 months, but it is worth holding on to these stocks valuation multiples have contracted sharply. Quality small-caps will once again emerge as winners," Chokkalingam says.

Among sector in the small-and mid-cap segments, Prabhakar is bullish on select stocks from the life insurance, power, fertiliser and chemicals, defence, banks, hotels and auto ancillaries.

)