Metal prices weaken on global macro factors

Rising dollar likely to put more pressure on base metal prices

)

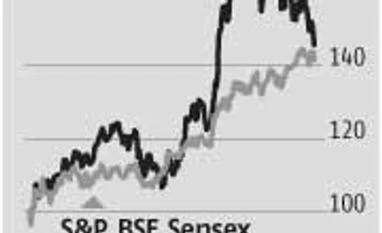

September is proving to be a rough month for the metals sector. In the first half of the month, prices of steel and base metals have fallen further on poor demand and weaker raw material costs. The strengthening dollar has made matters worse for base metals and internationally prices of aluminium are expected to correct further. With demand from China cooling off and raw material prices coming down on over-supply, prices of steel and other base metals are expected to remain under pressure.

Prices of Export HRC (FOB Black Sea) have drifted down to $540 a tonne, while Chinese HRC sheets declined to $498 a tonne. Given that Indian metal prices are benchmarked against global prices, domestic metal companies will not be able to take price hikes. Emkay Global says, "We believe weakness to prevail in steel prices globally and this in would continue to restrict domestic prices form going up. Iron ore prices kept falling further on higher supply and demand concerns from China. Coking coal spot prices, too, drifted lower."

Aluminium has been the worst hit, in terms of price fall, thanks to the strengthening dollar index. By September 15, aluminium declined six per cent to $1,959 a tonne. Other base metals like lead, zinc and copper also fell. Analysts claim the fall in prices is due to the rise in inventories of all base metals other than aluminium on the LME. Macroeconomic conditions across the world seem to suggest the demand for metals may remain subdued, as US non-farm payrolls have disappointed, the gross domestic product of Japan in the second quarter has dipped, while India's industrial production also disappointed.

In India, too, the sector is seeing unique issues. While sentiment has improved, demand has not yet picked up. Tata Steel, for instance, gets 30 per cent of its total 17 million tonne iron ore requirement from its Jharkhand mines, which have been ordered to shut down. However, the company expects a quick resolution. Morgan Stanley, which went on a field trip to meet metals companies, says, "A lack of availability of iron ore and coal could curtail the ramp-up and capacity utilisation of some projects in the medium term."

The cancellation of coal blocks will also have an impact on the performance of the sector. The cost of production at Hindalco's Aditya and Mahan smelters stands at $1,700 a tonne using imported coal. If domestic coal is available then the incremental cost benefit would be $400-50 a tonne, says Morgan Stanley. By and large, the regulatory risk continues to plague metal producers at home as do weak global prices.

Aluminium has been the worst hit, in terms of price fall, thanks to the strengthening dollar index. By September 15, aluminium declined six per cent to $1,959 a tonne. Other base metals like lead, zinc and copper also fell. Analysts claim the fall in prices is due to the rise in inventories of all base metals other than aluminium on the LME. Macroeconomic conditions across the world seem to suggest the demand for metals may remain subdued, as US non-farm payrolls have disappointed, the gross domestic product of Japan in the second quarter has dipped, while India's industrial production also disappointed.

In India, too, the sector is seeing unique issues. While sentiment has improved, demand has not yet picked up. Tata Steel, for instance, gets 30 per cent of its total 17 million tonne iron ore requirement from its Jharkhand mines, which have been ordered to shut down. However, the company expects a quick resolution. Morgan Stanley, which went on a field trip to meet metals companies, says, "A lack of availability of iron ore and coal could curtail the ramp-up and capacity utilisation of some projects in the medium term."

The cancellation of coal blocks will also have an impact on the performance of the sector. The cost of production at Hindalco's Aditya and Mahan smelters stands at $1,700 a tonne using imported coal. If domestic coal is available then the incremental cost benefit would be $400-50 a tonne, says Morgan Stanley. By and large, the regulatory risk continues to plague metal producers at home as do weak global prices.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Sep 23 2014 | 9:35 PM IST