<b>Your money:</b> Diligent paperwork helps in claiming tax benefits

Any lapse in documentation by an employee will lead to sharp cuts in salary

)

premium

tax

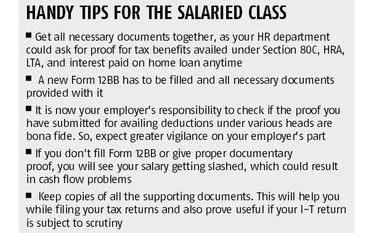

Last year, Rahul Sharma, an employee with a reputed fast-moving consumer goods (FMCG) company, realised the importance of paperwork and timely submission of investment documents to his employer when he received a fifth of his monthly salary. This year, he was relaxed when he got the official e-mail from his payroll department for investment papers and other tax-related documents before January 20. However, without reading the e-mail carefully, he gave copies of his investment documents against the declaration submitted at the beginning of the year. Unfortunately, he missed out on the newly-introduced requirement of making such claims in the prescribed Form 12BB. He again got a shock when he discovered that his January salary was lower than what it should have been. When he called the personnel concerned, the latter rattled off his mistakes: Not submitting Form 12BB for claims like house rent allowance (HRA), leave travel assistance (LTA) and interest on the housing loan. Once again, Sharma had to make amends by filling up the required form and providing the missing documents. Like Rahul, you too could face similar problems if you fail to give investment documents to your employer with Form 12BB.

Introduction of new form

With the change in law and introduction of this form (12BB), all claims like LTA, HRA, Section 80C investments, and interest on home loans have been put under tight scrutiny by employers, as they have the obligation to obtain, assess and verify the necessary evidence for the claims filed by employees for enjoying various deductions. Earlier, in the absence of a standard process and form, different employers followed different approaches. Some even relied on self-declaration made by employees.

This form has been introduced in the current financial year and became applicable from June 1, 2016. It has to be filled, self-certified and submitted to the employer. This is a significant change from last year. Any attempt by employees to self-verify a false declaration or inaccurate particulars may attract penal consequences under the Income-Tax Act.

Pay heed to paperwork

In the current scenario, employees should take the required paperwork seriously to avoid higher deduction of taxes. The changes to the rules also enhance the risk of selection of the filed return for scrutiny or verification by the tax authorities. You also need to be diligent to avoid an adverse cash flow situation in the final months of the year.

Let us now turn to how employees can go about obtaining various deductions, and the supporting documents they need.

Section 80C: The limit of deduction under this section is Rs 1.5 lakh. For many, this is exhausted by their contribution to Employees’ Provident Fund (EPF), deducted by employers every month. If this hasn’t happened (because your employer is exempted from PF contribution), ensure you have put money in other prescribed instruments eligible for Section 80C deduction. Give details of these investments in Form 12BB, along with supporting evidence. Similarly, for other deductions claims — under Section 80, medical premium under (80D), contribution to the National Pension Fund under 80CCD — you need to fill details in this form.

Introduction of new form

With the change in law and introduction of this form (12BB), all claims like LTA, HRA, Section 80C investments, and interest on home loans have been put under tight scrutiny by employers, as they have the obligation to obtain, assess and verify the necessary evidence for the claims filed by employees for enjoying various deductions. Earlier, in the absence of a standard process and form, different employers followed different approaches. Some even relied on self-declaration made by employees.

This form has been introduced in the current financial year and became applicable from June 1, 2016. It has to be filled, self-certified and submitted to the employer. This is a significant change from last year. Any attempt by employees to self-verify a false declaration or inaccurate particulars may attract penal consequences under the Income-Tax Act.

Pay heed to paperwork

In the current scenario, employees should take the required paperwork seriously to avoid higher deduction of taxes. The changes to the rules also enhance the risk of selection of the filed return for scrutiny or verification by the tax authorities. You also need to be diligent to avoid an adverse cash flow situation in the final months of the year.

Let us now turn to how employees can go about obtaining various deductions, and the supporting documents they need.

Section 80C: The limit of deduction under this section is Rs 1.5 lakh. For many, this is exhausted by their contribution to Employees’ Provident Fund (EPF), deducted by employers every month. If this hasn’t happened (because your employer is exempted from PF contribution), ensure you have put money in other prescribed instruments eligible for Section 80C deduction. Give details of these investments in Form 12BB, along with supporting evidence. Similarly, for other deductions claims — under Section 80, medical premium under (80D), contribution to the National Pension Fund under 80CCD — you need to fill details in this form.