AIFs bloom on easier norms

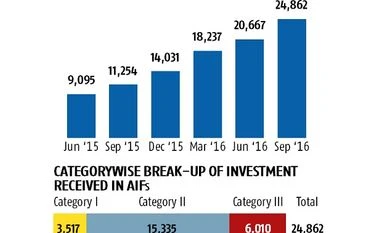

Total inflows double to Rs 24,862 crore over past year; however, more changes needed, say observers

)

premium

AFIs

Last Updated : Jan 24 2017 | 12:08 AM IST

Alternative Investment Funds (AIFs) are reaping dividends from an easier regulatory framework. In the past year, investments made by these entities have increased more than two fold to Rs 24,862 crore, shows data from the Securities and Exchange Board of India (Sebi).

AIFs are pooled funds, similar to mutual funds but with more liberal investment norms. The investment size is higher, given the high risk associated with these products.

There are three categories. Category-I comprises infrastructure, social venture and small & medium enterprise funds. These attract special concessions, including tax breaks for investors, and were designed to fund capital-intensive sectors.

Category-II consists of private and equity funds that are allowed to invest anywhere in any combination. However, these cannot invest in debt except for day-to-day operations. These funds are the most popular among investors and account for more than half of all AIF inflows.

Category-III are funds that make short-term investments and then sell. This category includes hedge funds.

Among the most significant of the changes mentioned at the outset, say those in the segment, was allowing the direct participation of foreign venture capital investors (FVCI).

Earlier, these venture capitalists needed prior approval from the Reserve Bank of India (RBI) to invest in these funds.

Another step the government took to was to provide ‘pass-through’ taxation status for category-I and category-II AIFs. This was announced in the Union Budget for 2015-16. And, pension funds and non-resident Indians (NRIs) were given permission to invest in the AIF space in 2016.

“With liberalisation in exchange control norms, foreign investments in AIFs have been permitted under the automatic route, which means the Foreign Investment Promotion Board FIPB approval requirement and the stringent conditions attached have been done away with. This has led to a substantial increase in AIF registrations and the amount of foreign money being raised has gathered unprecedented momentum,” said Tejesh Chitlangi, partner, IC Legal.

Market participants say angel fund participation in AIFs has also gone up significantly. Last year, Sebi had lowered the minimum size for them to Rs 25 lakh from the earlier Rs 50 lakh, and brought down the lock-in period to one year from the earlier three years.

AIFs are now finding favour among wealthy individuals, who participate in these through Category-III funds. This participation of high net worth individuals (HNIs) has led to a three-fold surge in the inflow received in category-III since September 2015.

“HNIs are increasingly opting for AIFs as they offer a better risk-reward. They can leverage the high investment size in AIFs and get good returns,” said Vikaas Sachdeva, chief executive officer, Edelweiss Asset Management.

Experts say a lot of work remains if these investment vehicles are to flourish. For instance, the long-standing demand for ‘pass-through’ taxation on hedge funds. Such funds are at a disadvantage when compared to other venture capital and private equity funds which participate in AIFs.

There is also a need to bring the taxation rates on AIFs at par with domestic mutual funds, experts add.

To clear regulatory hurdles and provide a more robust working environment for AIFs, Sebi had appointed a 11-member committee headed by Infosys founder Narayana Murthy. It has given two reports so far, suggesting numerous changes.