Samsung's S8 plan: Move over Note 7 debacle before Apple comes with iPhone8

With iPhone8 to be launched only in the second half of 2017, the field is wide open for Samsung

)

premium

In the cut-throat world of smartphones, out of sight is virtually out of mind. And if the period of absence stretches to over six months, bouncing back can be a real challenge. Korean chaebol Samsung appears to have taken this challenge head-on with the launch of the S8, its flagship smartphone that is coming after the Note 7 crisis in October.

How serious Samsung is about the S8 can be gauged from this: the phone, along with its upgraded version, the S8+, was unveiled in India on April 19 within a month of its global launch. The intent, say experts, is clear: take on rival Apple which has grown its share in the super-premium category — phones that are priced at ~50,000 and above.

Samsung and Apple have traditionally clashed head-on in this segment described as the “creamiest” of smartphone categories. India is among their favourite battlegrounds owing to the consistent growth of the overall smartphone market here. While demonetisation did take the sheen off the market in the fourth quarter of 2016, India’s smartphone category closed the year at around 113 million units, a modest growth of 19 per cent over the previous year, according to Cybermedia Research.

Consumers, says Niel Shah, analyst, Counterpoint Research, are not sensitive to price in the super-premium category, and focus instead on the kind of features that players bring to the table.

Both Apple and Samsung have fought to outdo each other in terms of product features, raising the bar with every launch. The S8, for instance, has a feature called “infinity display” that takes the curved screen display, which offers a cinema-theatre like view, to the next level, says Shah.

The illusion of a big screen with no boundaries, he says, is complete with infinity display, with no home button as distraction. The home button, interestingly, has given way to a softer key with a pressure sensor embedded under the display, sector experts say. Additionally, Samsung has taken the fight to Apple’s door with the launch of a talking assistant called Bixby on the lines of Apple’s Siri. The S8 also has a facial recognition app.

“These features could be a big draw in India, especially infinity display. The latter could click here because display plays a key role for smartphone buyers in India,” Shah says.

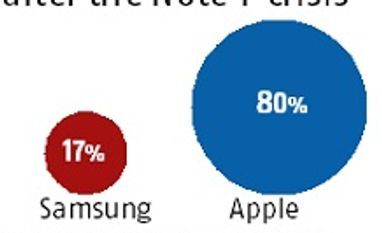

Prior to the Note 7 crisis, Samsung’s market share was 50-55 per cent, while Apple’s share was 45-46 per cent (in the super premium category), data sourced from Cybermedia Research shows.

Following the Note 7 crisis, Samsung’s share reduced to 17 per cent, according to data from Cybermedia Research for January and February 2017. March figures are not yet available.

Apple, on the other hand, saw its share grow to 80 per cent in January and February 2017, Faisal Kawoosa, principal analyst, telecom and semitronics, CyberMedia Research, says: “The addressable market for Samsung therefore in the super-premium smartphone segment has actually shrunk in the last few months, implying that the company will have to work really hard to regain lost ground.”

According to industry experts, the super-premium smartphone category in India is about 4 per cent (or 4.5 million units) of the overall 113-million-unit domestic smartphone market. This means the fight for market share will not be easy for Samsung in a niche category.

“While the super-premium segment is a growing one, it is still relatively small,” Kawoosa says. “So if one player gains share at the cost of the other, it will not be easy for the other to bounce back. In Samsung’s case, residual memories of batteries burning still linger in consumers’ minds. So people will be careful when buying,” he says.

Finding its way back

Samsung executives, though, are confident of staging a comeback. In an earlier conversation with Business Standard, Asim Warsi, senior vice-president for mobile business, Samsung India, said that quality was the top-most priority for the company and that it would take all necessary safeguards in this regard.

In the case of the S8, this translates, say experts, into an 8-level battery check, introduced after the Note 7 battery explosions, which not only hit sales, but also dented Samsung’s image as a solid performer.

How serious Samsung is about the S8 can be gauged from this: the phone, along with its upgraded version, the S8+, was unveiled in India on April 19 within a month of its global launch. The intent, say experts, is clear: take on rival Apple which has grown its share in the super-premium category — phones that are priced at ~50,000 and above.

Samsung and Apple have traditionally clashed head-on in this segment described as the “creamiest” of smartphone categories. India is among their favourite battlegrounds owing to the consistent growth of the overall smartphone market here. While demonetisation did take the sheen off the market in the fourth quarter of 2016, India’s smartphone category closed the year at around 113 million units, a modest growth of 19 per cent over the previous year, according to Cybermedia Research.

Consumers, says Niel Shah, analyst, Counterpoint Research, are not sensitive to price in the super-premium category, and focus instead on the kind of features that players bring to the table.

Both Apple and Samsung have fought to outdo each other in terms of product features, raising the bar with every launch. The S8, for instance, has a feature called “infinity display” that takes the curved screen display, which offers a cinema-theatre like view, to the next level, says Shah.

The illusion of a big screen with no boundaries, he says, is complete with infinity display, with no home button as distraction. The home button, interestingly, has given way to a softer key with a pressure sensor embedded under the display, sector experts say. Additionally, Samsung has taken the fight to Apple’s door with the launch of a talking assistant called Bixby on the lines of Apple’s Siri. The S8 also has a facial recognition app.

“These features could be a big draw in India, especially infinity display. The latter could click here because display plays a key role for smartphone buyers in India,” Shah says.

Prior to the Note 7 crisis, Samsung’s market share was 50-55 per cent, while Apple’s share was 45-46 per cent (in the super premium category), data sourced from Cybermedia Research shows.

Following the Note 7 crisis, Samsung’s share reduced to 17 per cent, according to data from Cybermedia Research for January and February 2017. March figures are not yet available.

Apple, on the other hand, saw its share grow to 80 per cent in January and February 2017, Faisal Kawoosa, principal analyst, telecom and semitronics, CyberMedia Research, says: “The addressable market for Samsung therefore in the super-premium smartphone segment has actually shrunk in the last few months, implying that the company will have to work really hard to regain lost ground.”

According to industry experts, the super-premium smartphone category in India is about 4 per cent (or 4.5 million units) of the overall 113-million-unit domestic smartphone market. This means the fight for market share will not be easy for Samsung in a niche category.

“While the super-premium segment is a growing one, it is still relatively small,” Kawoosa says. “So if one player gains share at the cost of the other, it will not be easy for the other to bounce back. In Samsung’s case, residual memories of batteries burning still linger in consumers’ minds. So people will be careful when buying,” he says.

Finding its way back

Samsung executives, though, are confident of staging a comeback. In an earlier conversation with Business Standard, Asim Warsi, senior vice-president for mobile business, Samsung India, said that quality was the top-most priority for the company and that it would take all necessary safeguards in this regard.

In the case of the S8, this translates, say experts, into an 8-level battery check, introduced after the Note 7 battery explosions, which not only hit sales, but also dented Samsung’s image as a solid performer.