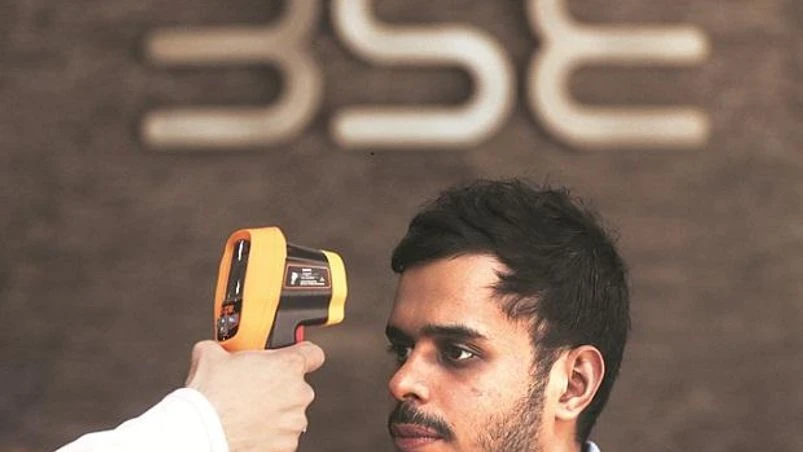

Market Wrap, April 28: Here's all that happened in the markets today

Market Wrap, April 28: Here's all that happened in the markets today

The S&P BSE Sensex gained over 371 points or 1 per cent to settle at 32,114.52, with IndusInd Bank (up nearly 17 per cent) being the top gainer

BS Web Team New Delhi

)

Sharp rally in financial stocks due to better-than-expected March quarter results (Q4FY20) of IndusInd Bank and Axis Bank-Max Financial deal, helped benchmark indices end over 1 per cent higher on Tuesday.

Private-sector lender Axis Bank said it would acquire an additional 29 per cent stake in Max Life Insurance, raising its total stake in the private life insurer to 30 per cent after the completion of the deal. The lender is also slated to release its March quarter numbers later in the day.

The S&P BSE Sensex gained over 371 points or 1 per cent to settle at 32,114.52, with IndusInd Bank (up nearly 17 per cent) being the top gainer. HDFC, ICICI Bank, and Axis Bank were among the major contributors to the index's gains. On the flip side, FMCG major Hindustan Unilever (HUL), and Sun Pharma were the top drags.

On the NSE, the benchmark Nifty ended at 9,380.90, up 99 points or 1 per cent. Volatility index India VIX declined 7.6 per cent to 35.14 levels.

Buzzing stocks

Among individual stocks, shares of IndusInd Bank surged 18.05 per cent intra-day, to hit a high of Rs 480.9, on the BSE after brokerages maintained 'buy' call on the stock due to its better-than-expected operationally strong March quarter performance. The stock eventually ended at Rs 468.90, up 15 per cent. On the NSE, it ended at Rs 476.95, up 17 per cent.

Shares of Max Financial Services and Axis Bank traded higher after the private sector lender said it would acquire an additional 29 per cent stake in Max Life Insurance. Max Financial Services, Max Life's parent company, will hold the remaining 70 per cent in the joint venture. At close, Max Financial Services stood at Rs 475.80, up over 5 per cent while Axis Bank ended over 6.6 per cent higher at Rs 455.55 apiece on the BSE.

Also Read

Shares of Just Dial rallied over 11 per cent to Rs 388 on the BSE after the company announced that it will consider share buyback proposal on Thursday.

On the sectoral front, Nifty Private Bank index gained the most - up 3.56 per cent to 11,243.55 levels while Nifty Pharma fell the most - down over 2 per cent to 9,386.20 levels.

In the broader market, the S&P BSE MidCap index gained 0.8 per cent to 11,723 while the S&P BSE SmallCap index ended at 10,862.54, up 0.77 per cent.

Global Markets

Oil prices plunged for a second day in a row on Tuesday on concerns about dwindling global capacity to store more crude and fears that demand may be slow to recover even after countries ease restrictions to combat the coronavirus pandemic.

Brent crude fell 83 cents, or 4.1 per cent, to $19.16 a barrel at the time of writing of this report, following a 6.8 per cent slide on Monday.

US West Texas Intermediate (WTI) crude was down $2.57, or 20 per cent, at $10.21 a barrel. The contract plunged 25 per cent on Monday.

In stock markets, European shares hovered near two-week highs as a slate of strong earnings reports from companies, including Novartis and UBS, outweighed a slump in oil prices and shares of Wirecard.

More From This Section

Topics :MARKET WRAP

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Apr 28 2020 | 4:47 PM IST