This could stop the Reserve Bank of India (RBI) from cutting rates in its policy review next month to spur falling industrial growth even as core inflation (relating to manufactured products sans food items) fell to 4.55 per cent, from 4.61 per cent.

However, inflation in various household goods and services declined, implying the goods and services tax (GST) did not have much impact.

The GST Council’s recent decision to cut the rates on around 200 items is likely to further dampen the rate of price rise of these items.

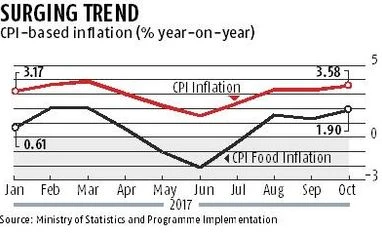

Food inflation moved up to 1.9 per cent in October, from 1.25 per cent in September. The main reason was vegetable prices, with inflation in these up from 3.92 per cent to 7.4 per cent. Onions and tomatoes appear the main causes. Elsewhere among food items, prices moved in a narrow range. Pulses continued to show a fall in prices at a higher pace, of 23.1 per cent, compared to 22.5 per cent in September. Inflation in fuel and light was up at 6.36 per cent, from 5.56 per cent as global crude oil prices rose and despite the cut in excise duty. The average price of the Indian basket of crude oil rose to $56.06 a barrel in October, from $54.52 in September.

Inflation in household goods and services such as health, transport and communication, recreation & amusement, and education declined in October. The RBI had projected inflation to rise to 4.2-4.6 per cent in the second half (H2) of the financial year (October to March). The rise in the Index of Industrial Production fell to 3.8 per cent in September, from 4.2 per cent in August.

“With the CPI inflation expected to track a rising trend over H2 FY18 and print at around 4.5 per cent in March 2018, there is a low likelihood of rate cuts in the immediate term. We expect an extended pause amid non-unanimous voting by the MPC in the December 2017 policy review,” says Icra Principal Economist Aditi Nayar.

)