What is GST? Your 10-point guide to independent India's biggest tax reform

GST is a reality now. Here are some important things you need to know about the new tax

)

premium

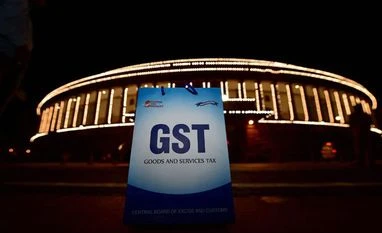

The Goods and Services Tax (GST) is a uniform indirect tax levied on goods and services across the country. Photo: PTI

The Goods and Services Tax (GST), India's biggest tax reform since Independence, was on Friday launched at midnight by President Pranab Mukherjee and Prime Minister Narendra Modi at Parliament's historic Central Hall. With the stroke of the gong, the current tax rates were replaced by GST rates. GST, which replaces a slew of indirect taxes with a unified one, is set to dramatically reshape the country's $2-trillion economy.

Here is a snapshot of some of the important things you need to know about the new tax regime:

Here is a snapshot of some of the important things you need to know about the new tax regime: