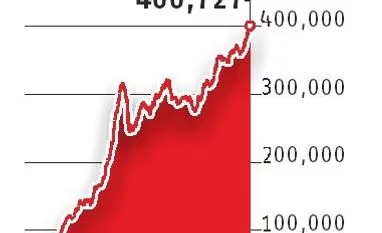

India's forex reserves cross $400 billion

Gold's value in the total reserves was about $20.7 billion, while SDRs of the IMF stood at $1.5 billion

)

premium

Last Updated : Sep 16 2017 | 12:35 AM IST

India’s foreign exchange reserves crossed the $400-billion mark last week, data released with a lag of seven days by the Reserve Bank of India (RBI) showed.

As of September 8, the forex reserves with the central bank stood at $400.73 billion, up $2.6 billion from a week earlier. Most of the reserves — about $376.20 billion — are held in foreign currency assets such as the US dollar, euro, pound sterling, Japanese yen, etc, and is valued in terms of the American greenback.

While the RBI does not provide a break-up of its foreign currency assets, analysts peg the share of the dollar to be between 60 per cent and 70 per cent of the total foreign currency assets.

The value of gold in the total reserves was about $20.7 billion, while the Special Drawing Rights (SDR) of the International Monetary Fund (IMF) stood at $1.5 billion. The reserve position in the IMF, which is the quota allotted to India minus the IMF’s rupee holding, was $2.3 billion.

A year earlier, total reserves were about $371 billion. The reserves have swollen particularly in the past three years after the Bharatiya Janata Party achieved a landslide victory to form the government at the Centre.

The RBI lapped up dollars aggressively as foreign investors started pouring in a huge amount of money in local assets. In the absence of intervention by the central bank, the rupee could have strengthened much more than how it has moved since its lowest in August 2013 at 67.87 a dollar. The rupee closed at 64.08 on Friday.

The Reserve Bank under former governor D Subbarao, did not accumulate dollars, as it let the market forces determine an appropriate rupee value. That practice was reversed by Raghuram Rajan, who in his three years — up till September 2016 — added about $77 billion in reserves.

Urjit Patel, the current governor, has stepped on the gas a bit more. In his first year, he has added about $30 billion in reserves so far.

India’s import cover has now crossed more than 12 months, indicating the capability of reserves to take care of the country’s normal functioning for the next one year. The import cover had fallen to less than seven months in 2013.

However, economists say the boost in forex reserves is a result of capital flows, and not from trade surplus. Therefore, the money can go out the same way it has come, and the central bank will have to intervene again, this time selling dollars, to protect the rupee’s value.

Therefore, the numbers might look great, but the quality of the reserves could still be shaky, say economists.