Air India asks RBI to relax loan recast rules

Lenders want to reduce the risk of equity component

)

premium

graph

Last Updated : Feb 23 2017 | 1:42 AM IST

The Reserve Bank of India (RBI) might relax rules for Air India’s loan recast scheme because banks are unwilling to take equity in a company that might be difficult to encash.

If negotiations are successful, the RBI will allow a unique arrangement in the Sustainable Structuring of Stressed Asset (S4A) scheme under which Air India plans to recast its loans into equity for banks, according to people familiar with the development.

Two people close to the development said after consultations with the lenders’ consortium, Air India has approached the RBI for relaxation of certain guidelines of the S4A scheme. Primary among them is a reduction of the unsustainable portion of the debt in order to reduce risk for the banks.

The S4A scheme requires lenders to divide a company’s debt into sustainable and unsustainable parts. The company has to service the sustainable part regularly, and lenders convert the unsustainable part into equity or debentures which can be sold later.

Air India has also requested the restructuring period be increased from six quarters to 12 because it feels six quarters is too short to show a substantial improvement in the aviation business. The guidelines framed by the RBI last June, which were refined in September, require lenders to find a resolution in six quarters.

“We have asked the RBI to relax the rules for us. This will be a special arrangement for Air India, the loan restructuring will have a separate name,” said an Air India executive involved in the negotiations.

A banker said both the lenders and the airline wanted to reduce the unsustainable part of the debt. “Air India's reasoning is a sizeable portion of loans for aircraft acquisition is guaranteed by the government and should be treated as sustainable debt," the banker said.

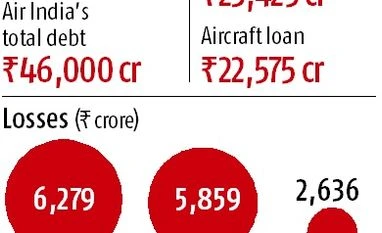

Air India’s debt at the end of 2015-16 was Rs 46,000 crore, of which Rs 22,575 crore is on account of aircraft loans which has been raised partially from EXIM Bank and rest via NCDs (non-convertible debentures) and bonds guaranteed by the Government of India

“The majority of the lenders support this. It will reduce the risk for the banks," the airline executive said. “Aviation is heavily dependent on external factors like fuel prices and geopolitics. The airline is doing well today, it may do better or worse in the near future. Hence the request for a longer resolution period," he added.

“Banks will have to provision more if the unsustainable debt is large, by reducing it they are curtailing the risk. But the million-dollar question is whether Air India will be able to service the sustainable part,” said Karthik Srinivasan, senior vice-president and group head of financial sector ratings at ICRA.

Credit rating agency CRISIL recently reaffirmed its AAA (SO) rating for Air India’s Rs 13,600 crore non-convertible debentures. “CRISIL believes the government’s guarantees for all the NCD programmes of Air India, together with the structured payment mechanism, will ensure repayment obligations of the company are met in a timely manner,” it wrote.

Air India on its part has written to the lenders that if the debt-equity swap takes place, it will triple EBITDA (earnings before interest, taxes depreciation and amortisation--a measure of a company’s operating performance) by 2019-20. “This year, we will record an operating profit of more than Rs 350 crore,” the airline executive said.

Ashwani Lohani, chairman and managing director of Air India, did not respond to queries on the loan restructuring but he is on record as saying that without debt, the company could post profits by 2018-19, against an earlier target of 2021-22.