According to the data provided by the BSE at 7:30 pm, the reserve book building (RBB) offer garnered only 1.25 billion bids, nearly 90 million short of the 1.34 billion required for the offer to succeed.

An earlier update on the BSE had showed that the RBB got 1.36 billion bids, but sources said these were confirmed bids and several of them were rejected.

The company sought a day’s extension from the Securities and Exchange Board of India (Sebi), citing a technical glitch at the exchange that halted the bidding for over an hour. At the time of going to press, the market regulator had not allowed an extension. The exchanges had, however, allowed the bidding process to remain open till 7 pm.

If Vedanta’s RBB fails to get bids for at least 1.34 billion shares -- the minimum required for the promoters to acquire 90 per cent shareholding -- then the delisting bid would fail. But if the company manages to cross the threshold, then the price at which at least 1.34 billion shares get tendered becomes the discovered price.

The data on the BSE at 6 pm showed that about 1.36 billion bids were received at Rs 320 or below. If these bids had been confirmed, then Rs 320 would become the discovered price. The promoter group was hoping that the discovered price would be below Rs 160 and had arranged for funds accordingly.

Sources said large shareholders Life Insurance Corporation (LIC) and Vanguard placed their bids at Rs 320 per share.

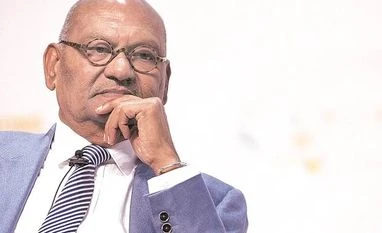

Vedanta Chairman Anil Agarwal indicated to a TV channel that the promoters would make a counter-offer if the discovered price was too high. He was hopeful of getting the minimum number of bids required for the RBB to succeed.

According to the delisting rules, the counter-offer has to be made within two working days. The counter-offer has to be more than the book value, which in Vendata’s case is Rs 89.3 and has to be acceptable to 90 per cent of the public shareholders.

However, if the RBB fails to get 1.34 billion bids, then the promoter can’t exercise the option of counter-offer.

“Given the stance taken by LIC, which holds a 6.37 per cent stake, and some other large investors, it is unlikely that the delisting bid will be successful if the offer price is below Rs 320,” said an analyst.

)