Aurobindo Pharma: Nod for niche drugs, strong pipeline to push earnings

Analysts at Elara Capital say Ertapenem approval gives comfort to Aurobindo's ability to grow its US business in FY19, despite the high base

)

premium

Aurobindo Pharma has been in the news and for good reasons. The most recent has been the receipt of an approval for a complex injectable product launch in the US. The approval of anti-bacterial injection, Ertapenem, provides a significant opportunity with limited competition.

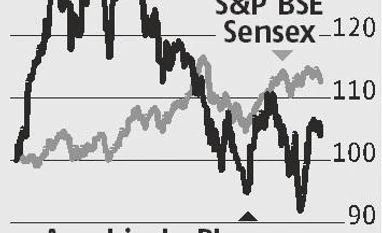

The approval has also boosted confidence in the company’s injectables portfolio and its US business. Concerns over pricing pressure in the US and FDA inspections at its various manufacturing units had pushed down its stock to 52-week lows in early June. With FDA clearance to its Unit-IV (manufactures injectables) and product approval from its penem injectables facility, Aurobindo’s prospects are looking better, say analysts.

The approved product (Ertapenem) is the generic version of Merck’s $387 million per annum brand. Assuming 60 per cent price erosion and 25 per cent market share, it could be $45-50 million revenue opportunity for Aurobindo in FY19, estimate analysts. Being a limited-competition complex product, its contribution to top line and profits will sustain for a longer period. With plans for three more penem launches, the Street is hopeful on Aurobindo.

Analysts at Elara Capital say Ertapenem approval gives comfort to Aurobindo’s ability to grow its US business in FY19, despite the high base. The clearance for Unit-IV should bolster new injectables launches and improve product supplies from the second half of FY19, add analysts.

The approval has also boosted confidence in the company’s injectables portfolio and its US business. Concerns over pricing pressure in the US and FDA inspections at its various manufacturing units had pushed down its stock to 52-week lows in early June. With FDA clearance to its Unit-IV (manufactures injectables) and product approval from its penem injectables facility, Aurobindo’s prospects are looking better, say analysts.

The approved product (Ertapenem) is the generic version of Merck’s $387 million per annum brand. Assuming 60 per cent price erosion and 25 per cent market share, it could be $45-50 million revenue opportunity for Aurobindo in FY19, estimate analysts. Being a limited-competition complex product, its contribution to top line and profits will sustain for a longer period. With plans for three more penem launches, the Street is hopeful on Aurobindo.

Analysts at Elara Capital say Ertapenem approval gives comfort to Aurobindo’s ability to grow its US business in FY19, despite the high base. The clearance for Unit-IV should bolster new injectables launches and improve product supplies from the second half of FY19, add analysts.