Here's why top angel investors take a back seat on investing in start-ups

Deal volumes fell 50 per cent and deal value by 33 per cent, according to an early estimate by VCCEdge

)

premium

graph

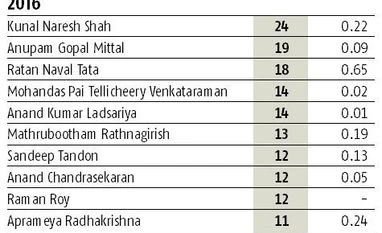

Anupam Gopal Mittal, founder of People Group and start-ups Shaadi.com and Makaan.com, has been a prolific investor. He was the top angel investor in 2014 and 2015, investing in 25 and 34 start-ups, respectively, and was second-ranked in 2016 with 19 deals.

Mittal, however, doesn't figure in the list of the top 10 angel investors of 2017. He's not alone. Almost all top angel investors have gone slow on investing in start-ups. Ratan Tata, who invested in 20 of these in 2015 and 18 in 2016, doesn't figure in the top 10 of 2017. Nor does Mohandas Pai, who backed 26 start-ups in 2015 and 14 in 2016.

Others have also gone slow. Rajan Anandan, who backed 24 start-ups in 2015, invested in 11 deals during 2017. Snapdeal founders Kunal Bahl and Rohit Bansal backed two dozen start-ups each in 2015, got busy with their company in 2016 and 2017, and took fewer bets.

‘‘It's market sentiment. People invest in cycles and that's true for all asset classes,'' says Kunal Shah, founder of FreeCharge, who topped the angel list in 2016 with 24 investments. ‘‘I think the market will keep correcting itself and operate in cycles.''

Mittal, however, doesn't figure in the list of the top 10 angel investors of 2017. He's not alone. Almost all top angel investors have gone slow on investing in start-ups. Ratan Tata, who invested in 20 of these in 2015 and 18 in 2016, doesn't figure in the top 10 of 2017. Nor does Mohandas Pai, who backed 26 start-ups in 2015 and 14 in 2016.

Others have also gone slow. Rajan Anandan, who backed 24 start-ups in 2015, invested in 11 deals during 2017. Snapdeal founders Kunal Bahl and Rohit Bansal backed two dozen start-ups each in 2015, got busy with their company in 2016 and 2017, and took fewer bets.

‘‘It's market sentiment. People invest in cycles and that's true for all asset classes,'' says Kunal Shah, founder of FreeCharge, who topped the angel list in 2016 with 24 investments. ‘‘I think the market will keep correcting itself and operate in cycles.''