UltraTech eyes Jaypee's Bhilai cement plant

Sources say Ultratech will pay around Rs 2,000 cr; deal will take UltraTech's overall capacity to 67 mtpa

)

The Manoj Gaur-promoted Jaypee Group has again fallen back on its cement assets to cut its debt. Group company Jaiprakash Associates is in talks with Aditya Birla Group flagship UltraTech Cement to sell its 2.2-million-tonne cement plant in Bhilai, Chhattisgarh. The plant is a joint venture between Jaypee Group (74 per cent stake) and public sector Steel Authority of India (26 per cent).

If the deal succeeds, this would be the third plant India’s largest cement maker UltraTech would be buying from the Jaypee Group in about a year and a half. “Jaiprakash Associates has a big pile of debt on its balance sheet and cement is the only business that allows it an easy exit,” said Piyush Jain, equity research analyst, Morningstar Investment Advisor.

The combined debt of the group’s three listed companies — Jaiprakash Associates, Jaiprakash Power Ventures and Jaypee Infratech — crossed Rs 57,000 crore in 2013-14. The group had earlier faced difficulty in selling its hydropower plants. Discussions had fallen through first with Abu Dhabi national energy company Taqa and then with Reliance Power. Finally, it sold a 1,391-Mw plant to JSW Energy for Rs 9,700 crore late last year.

Comparatively, selling the cement assets has been easier. In 2013, UltraTech acquired Jaypee’s 4.8-million-tonne-a year plant in Gujarat for Rs 3,800 crore. Last year, the Aditya Birla Group company bought two more plants, with a total capacity of 4.9 mtpa, in Madhya Pradesh for Rs 5,400 crore. Besides, Jaypee Associates sold a 1.5-mt grinding unit in Panipat, Haryana, to the H M Bangur-promoted Shree Cement.

ALSO READ: UltraTech sees life beyond cement

“Both the companies have been in talks for some time now and the deal is expected to materialise soon,” said an investment banker familiar with the talks.

A Jaypee Group spokesperson declined to comment and called the talk of a sale “speculative”. UltraTech declined to comment.

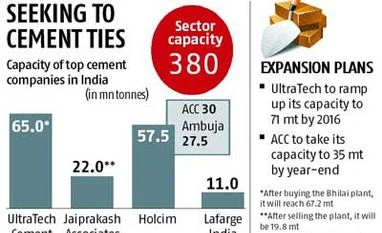

“If this deal happens, UltraTech will be a clear beneficiary. It will help the company consolidate its market share in the eastern region,” said Morningstar’s Jain. The Birla company will achieve a greater economy of scale as it gains size, taking UltraTech’s capacity to 67 mtpa — much ahead of the 57.5 mtpa of its closest competitor Holcim, which controls ACC and Ambuja Cements.

Jaypee currently has an overall annual capacity of 22 million tonnes, which is the third largest in the country. However, after the deal is inked, it will slip to below 20 million tonnes and will be in the category of mid-size cement firms with the likes of Shree Cement, Madras Cement and India Cements.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: May 21 2015 | 12:58 AM IST