Multi-billion exits at Flipkart may spur deal activity in start-ups

Expect an increase by 2nd quarter of this year

)

premium

Flipkart

The multi-billion exits at Flipkart may lead to an increase in deal activity in start-ups by second half of the year, say start-up observers.

The exits will boost the confidence of limited partners (LPs) who invest in venture capital (VC) firms. This will encourage VCs to deploy more as they would be more confident of raising new money, says a VC-turned-entrepreneur. ‘’Flipkart gives confidence to investors that India can produce global-scale firms,’’ says the partner at a VC firm.

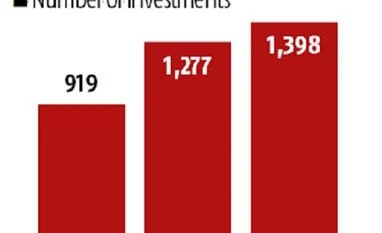

“Already deals are more competitive, valuations are going up. I see an increase in the pace of deal activity in second half of the year,’’ adds this person. “The number of entrepreneurs, investors and ticket sizes should increase deal activity 1.25x to 1.5x in 2018 over 2017,’’ says Rehan Yar Khan, managing partner, Orios Venture Partners.

There was slowdown in Series-C and Series-D deals between 2105 and 2017, as aggressive players like Tiger Global, Naspers and Softbank paused. ‘’We heard murmurs of lack of exits and returns from India which should get addressed by this deal. This will definitely swing the sentiment in reverse direction,’’ says entrepreneur K Ganesh.

The exits will boost the confidence of limited partners (LPs) who invest in venture capital (VC) firms. This will encourage VCs to deploy more as they would be more confident of raising new money, says a VC-turned-entrepreneur. ‘’Flipkart gives confidence to investors that India can produce global-scale firms,’’ says the partner at a VC firm.

“Already deals are more competitive, valuations are going up. I see an increase in the pace of deal activity in second half of the year,’’ adds this person. “The number of entrepreneurs, investors and ticket sizes should increase deal activity 1.25x to 1.5x in 2018 over 2017,’’ says Rehan Yar Khan, managing partner, Orios Venture Partners.

There was slowdown in Series-C and Series-D deals between 2105 and 2017, as aggressive players like Tiger Global, Naspers and Softbank paused. ‘’We heard murmurs of lack of exits and returns from India which should get addressed by this deal. This will definitely swing the sentiment in reverse direction,’’ says entrepreneur K Ganesh.