This has also boosted the Street's confidence on stocks of Indian aluminium producers such as Vedanta and Hindalco, up about five per cent and 16 per cent, respectively, from their lows in early April. Even Naational Aluminium (Nalco) has gained 14 per cent, with the rise in prices of alumina, a key input.

Despite the rally, analysts see more gains for the three companies. A foreign brokerage says aluminium prices are expected to rise on capacity shutdown by Norsk Hydro and US sanctions on UC Rusal, the Russain producer. They expect Hindalco, Nalco and Vedanta to benefit.

Rusal accounts for close to six per cent of global aluminium supplies and 13-14 per cent of overall supplies if China is excluded. Analysts at Kotak Institutional Equities say sanctions against the company could have an adverse impact on the global supply chain. Hence, they expect strong improvement in the outlook for prices in the next two years.

Not only are supplies from Rusal seen as getting curbed but its expansion plans, too. This and production-related discipline by Chinese players and a widening demand-supply deficit in the world (ex-China) is likely to keep aluminium prices firm.

Further, Edelweiss Securities believes the US sanctions might have a spill-over effect on Rusal's largest customer, Glencor. This is expected to further complicate the supply chain. This also adds to the alumina cost, after partial closure of the Alunorte refinery on February 27, affecting three per cent of global alumina supplies; it impacted the profitability of China's producers in March. The refinery in northern Brazil, owned by Norway's Norsk Hydro ASA, is seeing half its capacities being impacted due to orders from a Brazilian court.

Alumina prices, too, have risen by about 22 per cent in a month, as a result. Alunorte has the world's largest alumina refinery, contributing about five per cent to global output in 2017.

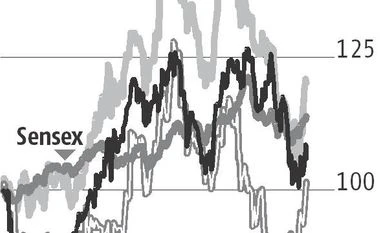

The non-ferrous Indian manufacturers had seen their share price fall in the recent past on increased concern over a global trade war. However, they are now finding favour with investors. Aluminium has the best demand outlook among base metals and could see structural pricing improvement, say analysts at Kotak Institutional Equities; they feel the stock prices were discounting low returns.

As the prospects of both Vedanta and Hindalco remain firm, Nalco, with higher exposure to alumina production, is also expected to see improved realisation. Despite rising volumes in the March quarter, analysts at Motilal Oswal Securities expected Nalco's operating profit to remain flat sequentially, mainly due to lower alumina prices. Now, however, given higher alumina prices and volumes, expect Nalco's performance to improve.

Rising alumina prices, however, could offset some of the gains for Vedanta as it outsources its alumina need, which will increase the cost of inputs. However, some analysts say that as demand and realisations improve, Vedanta will be able to pass on input costs in a better way. Hindalco is an integrated player and, hence, analysts feel it will benefit more.

Hindalco, thus, remains the top pick of analysts at JM Financial in the non-ferrous space. They say every $100 a tonne price movement on the LME changes Hindalco's fair value by Rs 28 a share and a $25 movement in Novelis' operating profit per tonne changes this by Rs 19 a share. Assuming an average per-tonne aluminium price at $2,100 and the dollar at 64 to the rupee, they have arrived at a target price of Rs 310 for the share. The current price is Rs 232.65. Edelweiss and Kotak's target prices for the share are Rs 315 and Rs 325, respectively.

On Vedanta, analysts see a gain of nearly 50 per cent from the Rs 289.35 on Thursday, as oil prices are also firm.

)