Seasonal weakness in Cephalosporins, Mylans’ launch in Minastrin (iron tablets launched by Lupin in March), Teva’s launch of diabetes drug Glumetza generics, decline in diabetes control Fortamet generic’s market share and further channel consolidation continued to hurt Lupin. Thus, North America’s contribution to revenues reduced to 35 per cent from 42 per cent in the previous quarters. But, India, Japan, and emerging markets (EMs) are growing well. India sales (almost a third of revenues), after being impacted by the goods and service tax-led destocking in the June quarter, rebounded to grow 16.4 per cent (24.3 per

cent sequentially). Asia-Pacific sales (16 per cent) grew 15.2 per cent y-o-y as EMs and Latin American sales — though contributors of only 7 and 4 per cent, respectively, to top line — grew 17 per cent and 41.5 per cent.

Lupin’s sales at Rs 3,874 crore declined 8 per cent y-o-y and came lower than the Rs 4,056 crore indicated by Bloomberg consensus estimates. Cost controls helped, as manufacturing and other expenses declined 16.8 per cent y-o-y and 5.5 per cent sequentially. Operating profit at Rs 853 crore came close to the Rs 870 crore estimated by analysts. The operating profits have improved 11 per cent sequentially, instigating some confidence towards a better second half performance.

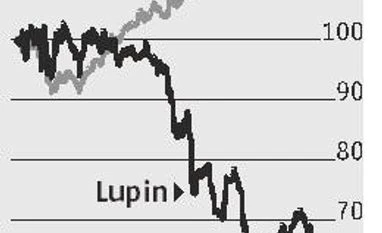

Helped by higher other income, net profit at Rs 455 crore grew 27.1 per cent sequentially (down 31.3 per cent y-o-y) and beat consensus estimates of Rs 443.50 crore. As a result, the Street sentiment was elevated. Lupin’s stock price gained 2.67 per cent to close at Rs 1,027.55 on Monday.

Analysts say the pressure on US sales may have bottomed out. Analysts at Motilal Oswal Securities had said in the result preview sales would bottom by Q2 FY18. Nikhil Khandelwal, managing director at Systematix Shares, says Lupin results were better than expected. All costs except material expenses are under control, and any significant improvement in sales growth will substantially increase profitability.

)