Vedanta may have to hinge on debt to finance Rs 560-bn capital expenditure

High dividend payouts, servicing of existing debt and relatively low cash profits may compel the metal-and-mining major to raise debt

)

premium

Vedanta

Last Updated : Aug 30 2018 | 5:30 AM IST

It may not be easy for Anil Agarwal-led Vedanta to carry out the $8-billion (Rs 560 billion) capital expenditure (capex) through internal accruals.

High dividend payouts, servicing of existing debt and relatively low cash profits may compel the metal-and-mining major to raise debt.

Last week, Chairman Navin Agarwal said through the capex, being planned over the next three years, the firm aims to grow by at least 50 per cent in revenue. “There is no plan at this point to raise any debt as we have comfortable cash flows. These (cash flows) will be used to fund expansion and hence the capex funding will largely be via internal accruals,” Agarwal told reporters on the sidelines of its 53 rd AGM held here last week.

Vedanta, which contributes 27 per cent to the domestic crude oil production, plans to take it up to 50 per cent. For this, the company will be investing $3-4 billion over the next two to three years in various growth projects. Vedanta is India’s largest private sector oil producer through its Cairn operations which merged with the company in April 2017.

Vedanta

In FY18, Vedanta saw a record production in zinc-lead-silver and aluminium businesses. “We would be further investing $3-4 billion in these businesses,” added Agarwal. In the steel sector, where the firm has recently forayed into through the acquisition of insolvent Electrosteel Steels, Agarwal plans to raise the existing 1.5 million tonnes capacity by another million tonne and will be investing $300-400 million. This investment is also part of the $8 billion capex plan.

Taking debt would be a necessity and not a difficulty for the company. “Vedanta continues to have one of the most deleveraged balance sheets in the metals space with net debt/Ebitda at 1.1x,” said Edelweiss in its June quarter results update report. “This will enable the company to pursue value-accretive growth opportunities such as Electrosteel Steels,” it said.

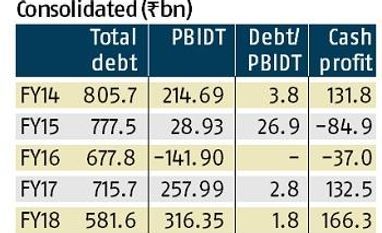

Analysts, however, are of the view that the company’s dividend payouts will continue to be a large part of the cash profits making it difficult for Vedanta to fund capex largely through internal accruals. Cash profits considered here is sum of depreciation and net profit. “Dividend payouts by Vedanta cannot be low as it is used by Vedanta Resources Plc to service debt. Currently, there is no major resource for the London-listed company to service its debt except the dividend from Vedanta,” said Giriraj Daga, portfolio manager at Visaria Securities.

Since the last two years, Vedanta has made hefty dividend payouts to its shareholders which rose from Rs 9.6 billion in 2013-14 to Rs 78.8 billion in 2017-18. A $8 billion (Rs 560 billion) capex over three years would be Rs 186.6 billion of capex every year.

On the cash profit front, however, post dividend payouts, Vedanta's consolidated cash profit is less than half the capex planned for every year over the three-year period.