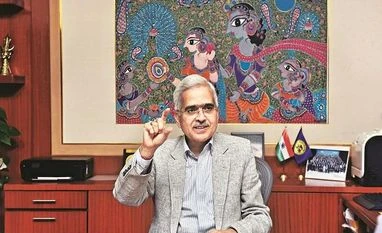

Bank lending to NBFCs set to gather pace: RBI Governor Shaktikanta Das

RBI's June 7 circular places onus on banks to take informed decisions while taking on exposure to the sector

)

premium

RBI Governor Shaktikanta Das

4 min read Last Updated : Jul 26 2019 | 1:11 AM IST

The fund crunch at non-banking financial companies (NBFC) must come to an end now with the government’s reassurance in the Union Budget and the Reserve Bank of India’s (RBI’s) massive liquidity infusion into the banking system, says RBI Governor Shaktikanta Das.

Though banks will still need to carry out their own risk assessment of such borrowers, the central bank has extended a helping hand by sharing the requisite information about large NBFCs, he adds.

In an exclusive interview to Business Standard, Das said the RBI was monitoring and scrutinising the top 50, and had a “good understanding of what are the numbers and cash flows of these firms”. “I think the credit flow (to the NBFC sector) will gather greater momentum very soon,” he said.

The Budget proposed that the government would offer credit guarantee on the first 10 per cent of losses for the highly rated, pooled assets worth Rs 1 trillion of financially sound NBFCs. The operational aspects are expected soon.

On the same day, the RBI provided additional liquidity of Rs 1.34 trillion to banks for the purchase of these assets from and for on-lending to NBFCs and housing finance companies (HFCs). This comes under the facility to avail of liquidity for the liquidity coverage ratio carved within the mandatory statutory liquidity ratio.

“We have assured banks in very clear and unambiguous terms that adequate liquidity will be provided to them to on-lend to the NBFC sector. I think the banks are making their own assessment of the individual NBFCs, and the lending cycle should start to gather momentum,” he said.

The governor, though, qualified that the RBI’s June 7 circular (which replaced its February 12, 2018, circular that was struck down by the Supreme Court) should be kept in mind as banks go about accommodating NBFCs. Simply put, quality will be a key driver when NBFCs seek to access credit from banks.

On transmission of interest rates by banks to borrowers on the back of the central bank’s policy rate cuts, Das was of the view that “conditions are absolutely conducive for faster transmission of interest rate cuts, at least for the new loans”.

There are some rigidities observed in old loans as banks are already tied to contractual obligations towards their depositors. Thus, it may take some time for the old loans to come down. He added this aspect had already been conveyed to state-run banks and would be communicated to private banks in his meeting with them next week.

On governance issues at state-run banks, Das said the RBI had given its suggestions to the government on such reforms, “broadly in the areas of accountability, performance review, tenure, remuneration, etc”. On their oversight, he was categorical that even as the RBI could not change PSBs’ boards, it could suggest the government to do so if there was a need. “So in regulation and supervision, we have enough powers and there is no differentiation between the public sector and private sector banks,” he added.

“I don’t see anything being a handicap for the RBI to carry out its duty as an effective regulator,” Das said.

On the RBI recently receiving the mandate to regulate HFCs as well, the governor said the central bank wanted to have the powers to regulate them because of “interconnectedness”. “Given the kind of interconnectedness that has happened over the last few years, it is desirable that there is one regulator that deals with all these financial intermediaries,” he said, adding that the problems in the HFC segment “are impacting the banking and NBFC sectors”.

Das, who has cut the policy repo rate by 75 basis points since February and changed the stance to ‘accommodative’, defended his action, saying that analysts and economists had welcomed the move. And in any case, the rates are now decided by the monetary policy committee based on the inflation and growth outlook, he said. “It’s a question of how the economy evolves and what is the requirement of the economy at particular points of time,” Das said.

Topics : NBFC Shaktikanta Das