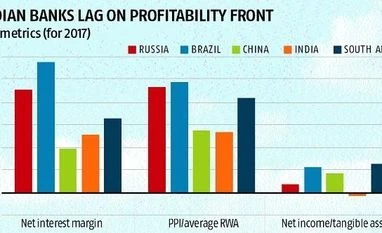

Indian banks' profitability weaker than BRICS peers, says Moody's report

Moody's says the system, as a whole, is unprofitable due to high credit costs at dominant state-owned banks

)

premium

Chart

Chinese banks had the lowest problem loan ratio of 1.5 per cent at the end of 2017, while Russian banks had the highest at 11.8 per cent, closely followed by those in India.