Why Tencent could become an advertising powerhouse like Facebook

Alibaba Group Holding now dominates Chinese digital advertising but investors are betting part of Tencent's future growth will stem from social media marketing

)

premium

Tencent graphic

Tencent Holdings’s rise into a $500 billion company was fuelled by a culture of internal competition, where teams raced against each other to make ideas work. To become an advertising powerhouse like Facebook, the internal barriers are starting to come down.

The seven main business units of China’s largest company are working to synchronise data and study a billion plus users to deliver precision and predictive ads, according to Lau Seng Yee, the executive tasked with leading the charge. That’s counter-intuitive for a company where ideas are generated from the bottom up, and divisions spanning games and video streaming to finance are encouraged to jockey against each other.

Tencent is counting on its user data - from the music people play, the news they read and the places they go — to deliver targeted commercials and capture a bigger share of China’s 350 billion yuan ($53 billion) online advertising market. Success in games and social media has meant the company hasn’t had to rely on ads, a business that generates just 17 per cent of its revenue compared with 97 per cent for Facebook.

“The outside world knows our core DNA is internal competition, but it needs to be healthy,” said Lau, who took over the newly created advertising role in March. ‘We spend a lot of time resolving our silos, torching our teams, and integrating the so-called strength of team.”

The fierceness of competition is exemplified by the fact that Tencent’s businesses actually vie with each other, with its WeChat and QQ social networking services having close to a billion users each. Its operations aren’t even all located in the same cities, with much of the WeChat team and its boss in Guangzhou, the online news business predominantly in Beijing while a big chunk of Lau’s team is in Shanghai. Tencent itself is based in Shenzhen.

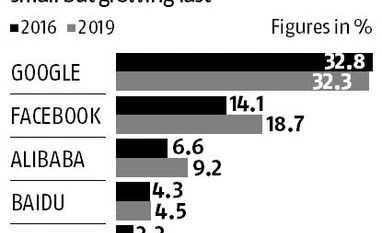

Alibaba Group Holding now dominates Chinese digital advertising but investors are betting part of Tencent’s future growth will stem from social media marketing. That’s helped Tencent more than double this year and briefly pass Facebook to become the world’s fifth most valuable company — cementing its position alongside Alibaba as standard bearers for China in an increasingly digital global economy.

Tencent’s ad revenue could more than double to $11.4 billion by 2019, according to researcher eMarketer. The company is estimated to increase its market share in China’s digital ad space to 15 per cent from about 9 per cent, eMarketer said. Shares in the company ended 1.1 per cent lower in Hong Kong.

“If you think about why advertisers like Facebook’s social ads, it’s because the data it has on users enables more precise targeting,” said Alex Yao, a Hong Kong-based analyst at JPMorgan Chase & Co. “Tencent has more abundant data on users than Facebook does.”