Driving the sales on the supply side were art pieces coming from single owner collections that included 600 lots from the collection of Mrs Henry Ford II. Cerutti said “private sales represent 25 per cent of our sales and more than ever we are getting to be very strong through channels where private buyers are consigned confidentially to us through sellers.”

Christie’s has organised a total of around 164 auctions this year with 88 of them being live and 76 online, officials said.

There was record participation from Asian buyers, who accounted for some 39 per cent of all sales, Cerutti said. There has been a strong influx of buyers and particularly millennials, who account for 30 per cent.

Christie’s has also introduced the NFT market, logging a record price for a work by Beeple called Everydays: The First 5000 Days that sold for close to $70 million. The buyer was the Metapurse fund, a group investing in digital art.

The crypto art market has always existed and what Christie’s has simply done is present it on the global stage, Cerutti said, adding that it will continue to get attention.

Online sales for all categories including watches have also been strong. The timepieces drew as much as $12 million in sales in Dubai. Overall, to date this year, Christie’s has seen watches total $93.7 million across 10 auctions in four cities in four months. Up for grabs were 1,681 watches, of which 10 were sold for over $1 million each.

Christie’s has accelerated sales of auction items to include collectibles that have ranged from period furniture to jewellery to tennis great Roger Federer’s Wimbledon rackets.

Francis Belin, president, Asia Pacific for Christie’s, sees the sales as a reflection of an ability to be able to sell worldwide for which digital sales channels are largely responsible. “There were record-breaking sales for handbags and watches, and Christie’s continued to invest heavily in digital channels such as WeChat mini programmes, which was a great way to engage customers from China.”

Specifically, Asia saw huge traction and interest in Christie’s auctions.

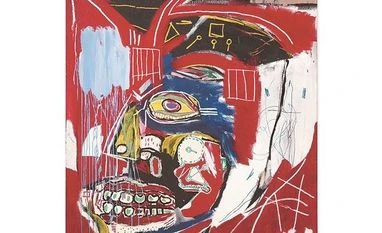

Giovanna Bertazzoni, Christie’s vice-chairman of the 20th/21st century, said that Europe, the West Asia and Africa saw at least 50 per cent more interest in terms of sales and business, and added that the enduring appeal of masterpieces remained critical. “The power of images that have a global bidding is harvested into our strategy and is what makes business more compelling,” she said referring to works by Picasso and Basquiat that broke records.

“India still has a great story ahead with a lot of activity and we do have a very global population of non-resident Indians who we see participating in auctions,” Belin said.

In some senses, the pandemic has helped auction houses drive sales with local Indian players such as Saffronart also logging very high and in some cases record prices for paintings by Indian masters in the last 18 months. An M F Husain oil on canvas called the Battle of Ganga and Jamuna: Mahabharata 12 sold for Rs 13.5 crore in March last year and an untitled work by V S Gaitonde in March this year amassed a record Rs 40 crore.

Today, as many as 500,000 people can follow a sale online in a venue that earlier never allowed even a telephone into the room, said Jussi Pylkkänen, global president at Christie’s. “There are very few items that are sold today that are not of global interest or have four different continents bidding for it. Very often the buyer is a new one.

)