Amara Raja trails Exide on margins

Pricing pressure, product mix saw these at a multi-quarter low

)

premium

Source: Analysts’ reports

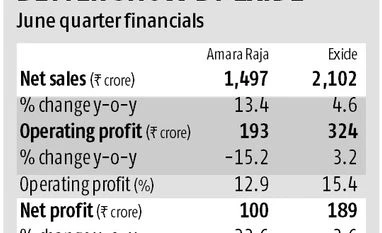

The stock of Amara Raja, the storage battery maker, among other items, is down 2.5 per cent after a below-expectation performance in the June quarter (Q1) across most parameters. Barring the strong revenue growth, up 13 per cent year-on-year to Rs 1,497 crore, the results disappointed, especially on the margin front.

Operating profit margin at 12.9 per cent, down 430 basis points (bps) over the year-before quarter, was the lowest in the past nine quarters.

The company said these were due to high pricing pressure in the industrial segment and lower operating profit margin in the home uninterrupted power system (UPS) segment (seven to eight per cent). On top of a weaker pricing environment and adverse product mix was the 400 bps year-on-year rise in raw material costs as a percentage of sales, to 70 per cent.

While peer Exide also saw raw material pressure and employee cost increase, its margin fall was restricted to 20 bps, to 15.4 per cent, ahead of analyst estimates of under 15 per cent. Lower other expenses helped. Exide is undertaking cost control and technology upgrade.

For Amara Raja, a poor margin show, higher tax rate and depreciation expense led to a 24 per cent year-on-year fall in net profit to Rs 100 crore.

Exide also had higher tax rates and lower other income in the quarter. Its net profit at Rs 89 crore was down to four per cent more, year-on-year.

Operating profit margin at 12.9 per cent, down 430 basis points (bps) over the year-before quarter, was the lowest in the past nine quarters.

The company said these were due to high pricing pressure in the industrial segment and lower operating profit margin in the home uninterrupted power system (UPS) segment (seven to eight per cent). On top of a weaker pricing environment and adverse product mix was the 400 bps year-on-year rise in raw material costs as a percentage of sales, to 70 per cent.

While peer Exide also saw raw material pressure and employee cost increase, its margin fall was restricted to 20 bps, to 15.4 per cent, ahead of analyst estimates of under 15 per cent. Lower other expenses helped. Exide is undertaking cost control and technology upgrade.

For Amara Raja, a poor margin show, higher tax rate and depreciation expense led to a 24 per cent year-on-year fall in net profit to Rs 100 crore.

Exide also had higher tax rates and lower other income in the quarter. Its net profit at Rs 89 crore was down to four per cent more, year-on-year.

Source: Analysts’ reports