Are Bharat Forge's prospects turning around now?

How the oil and gas vertical shapes up will also play a key role in incremental growth

)

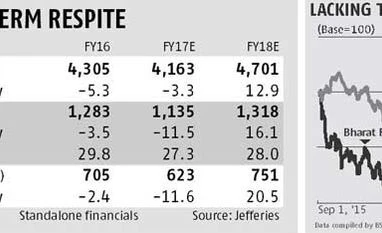

The Bharat Forge stock is up 17 per cent over the past month on expectations that sales to some of its key segments could improve.

The immediate trigger is the management commentary on the sales trend for Class-8 trucks in the North American market, which it said had bottomed out after being under pressure in recent times. Sales to this segment account for a fifth of standalone revenue. Volumes of Class-8 trucks in the US were down 26 per cent over a year to 14,000 units, the lowest August sales in six years. From July, though, sales were up 36 per cent due to fewer cancellations. Analysts at brokerage Prabhudas Lilladher say sales in the June quarter indicate an inventory level lower than what is required under current industry demand; restocking, when it takes place, will result in higher growth.

While automobile parts will continue to be Bharat Forge’s bread and butter, it is scaling up its newer verticals of aerospace and defence. How the oil and gas vertical shapes will also play a key role in incremental growth, as this segment has been responsible for weaker quarterly numbers for a while. Analysts indicate demand from the shale gas side is at its lowest and could see some uptick. As of now, the company is using its current oil and gas capacities to expand its services in the aerospace segment. Thanks to this flexibility in capacity use, the company managed to achieve a 27 per cent margin at the standalone level, with capacity utilisation of 65 per cent, despite fall in production and an unfavourable product mix.

While a section of analysts believe sales of segments that were under pressure have hit bottom, not all are convinced. Nomura analysts see downside risks to the estimates of a 25 per cent decline in Class 8 truck sales in the US. Further, a sharp slowing of truck sales in India is an incremental negative, as the company derives 17 per cent of standalone sales from this segment, they add.

Also, the smaller size of the railways and aerospace segments, one to two per cent of Bharat Forge’s revenue, will not offset the slowing in major segments. For the aerospace division, the company, which has a revenue target of $100 million over the next couple of years, expects revenues to start flowing from the second half of FY17 and accelerate in FY18. Given the near-term headwinds and sharp stock run-up, investors could await a fall in the stock price. At the current level of Rs 848, the stock is trading at 22 times its FY18 earnings estimate.

The immediate trigger is the management commentary on the sales trend for Class-8 trucks in the North American market, which it said had bottomed out after being under pressure in recent times. Sales to this segment account for a fifth of standalone revenue. Volumes of Class-8 trucks in the US were down 26 per cent over a year to 14,000 units, the lowest August sales in six years. From July, though, sales were up 36 per cent due to fewer cancellations. Analysts at brokerage Prabhudas Lilladher say sales in the June quarter indicate an inventory level lower than what is required under current industry demand; restocking, when it takes place, will result in higher growth.

While automobile parts will continue to be Bharat Forge’s bread and butter, it is scaling up its newer verticals of aerospace and defence. How the oil and gas vertical shapes will also play a key role in incremental growth, as this segment has been responsible for weaker quarterly numbers for a while. Analysts indicate demand from the shale gas side is at its lowest and could see some uptick. As of now, the company is using its current oil and gas capacities to expand its services in the aerospace segment. Thanks to this flexibility in capacity use, the company managed to achieve a 27 per cent margin at the standalone level, with capacity utilisation of 65 per cent, despite fall in production and an unfavourable product mix.

While a section of analysts believe sales of segments that were under pressure have hit bottom, not all are convinced. Nomura analysts see downside risks to the estimates of a 25 per cent decline in Class 8 truck sales in the US. Further, a sharp slowing of truck sales in India is an incremental negative, as the company derives 17 per cent of standalone sales from this segment, they add.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Sep 12 2016 | 10:44 PM IST