Best may be behind for sugar stocks

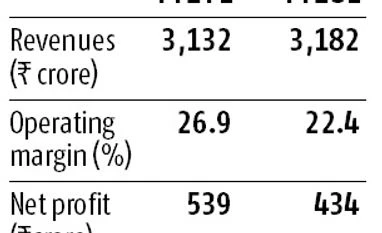

UP-based sugar producers better placed to continue with a stronger balance sheet on declining debt

)

premium

The government, in order to maintain the availability of sugar and keep prices under check, has again extended the stock-holding limit by six months. A few days ago, it had resorted to allowing duty-free imports, which will keep sugar prices in check. These measures suggest that a further upside in sugar prices from here on may be limited, and hence the major part of the rally in share prices of sugar companies is behind.

The uptrend in sugar prices on the back of tightening supplies has so far been the key reason for the strong rally in the share prices of sugar companies. The companies also benefitted from low opening stocks (inventories) at the start of the season. With India's sugar production declining, UP-based producers remain better-placed due to good availability of sugarcane in the northern state, as the rest of the key sugar-producing states such as Maharashtra and Karnataka saw a decline in sugar cane production and thus lower sugar production. Mill realisations had firmed up to Rs 39 a kg compared to Rs 36-37 in January, say analysts.