Best year for IPOs leaves investors high and dry

An analysis of post-listing performances of new paper issued via IPOs this year shows investors would have been better off betting on listed stocks

)

premium

graph

Last Updated : Nov 28 2017 | 2:18 AM IST

Ace investor Rakesh Jhunjhunwala prefers picking shares from the secondary market rather than applying in initial public offerings (IPOs).

The rationale behind this investment thesis is that IPOs often come at lofty valuations when the market sentiment is buoyant, leaving little gains on the table for investors. This investment strategy ties in with the experience of 2017, when the capital issued by way of initial public offerings (IPOs) has been the highest ever at Rs 66,169 crore (over $10 billion), surpassing the previous record of Rs 37,535 crore in 2010.

An analysis of post-listing performances of new paper issued via IPOs this year shows investors would have been better off betting on listed stocks.

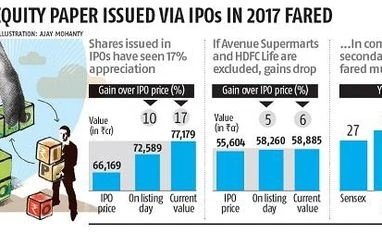

Sample this: The Rs 66,169 crore of new paper issued in IPOs saw an appreciation of 10 per cent on the listing day and extended gains by six per cent subsequently to nearly 17 per cent to Rs 77,179 crore.

In other words, an investor who bet on all the 33 IPOs of 2017 (on a weighted average basis) had seen the value of investment grow by 17 per cent, hugely underperforming the secondary market.

The Sensex has gained 27 per cent this year, while the broader market has performed much better, with the BSE Smallcap Index surging over 50 per cent.

The IPO scorecard in 2017 looks even weak if one excludes D-Mart retail chain operator Avenue Supermarts and private life insurer HDFC Standard Life. Though the former has seen its share price surge nearly four times, only a fraction of IPO applicants got allotment due to high demand; and while the latter surprised the Street with its post-listing performance, there weren’t enough takers for its shares in the IPO in the retail category. The Rs 55,604 crore issued via IPOs by 31 companies (excluding D-Mart and HDFC Life) saw only a 5 per cent appreciation on the listing day. This equity paper is up only 6 per cent to Rs 58,885 crore over its IPO price.

“IPO returns this year are not commensurate with the exuberance shown by both institutional and retail investors. Most shares were issued at high valuations, taking advantage of availability of high liquidity and the buoyancy in the secondary market. Investment in the secondary market, even mutual fund schemes tracking the Sensex or Nifty, would have yielded better returns for investors,” said an official with a leading brokerage.

A simple average of issue-to-date performances of 33 IPOs this year is an impressive 43 per cent. However, the average is skewed by superior returns of a couple of small-sized IPOs — for instance, Shankara Building Products, which has seen its shares jump 3.6 times after its Rs 345-crore offering and Apex Frozen Foods, which too has seen a 3.5 times surge in its shares after a Rs 152-crore IPO. Of the 33 IPOs, the issue-to-date returns for 13 companies — 39.4 per cent — have bettered that of the Sensex or Nifty performance of this year. Of the remaining 20, the shares of about a dozen companies are trading below their issue prices.