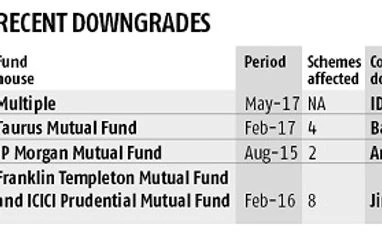

Recently, rating agencies downgraded IDBI Bank, which would have resulted in mark-to-market losses for mutual funds. But fund managers are little worried about it as their exposure is limited to the issuer and also because the bank is backed by the government. But if a scheme has a high exposure to a company facing downgrade, investors should consider their options. In February, when rating agencies downgraded Ballarpur Industries, Taurus Asset Management’s four debt scheme suffered losses. At that time, three schemes had exposure of over 11 per cent to Ballarpur Industries.

How much risk an investor should be willing to take in debt depends on his investment tenure. Medium and long-term debt investors with a horizon of over three years, have no choice but to put up with volatility. In categories such as credit opportunities fund, there’s always risk of downgrades as fund managers take exposure to papers that have lower ratings but give higher returns. In dynamic bond funds the returns could fall 1-2 per cent in a day if a fund manager’s call on interest rates goes wrong. If investors cannot stomach volatility, they should look at bank fixed deposit or other fixed income instruments.

Those investing for short-term – up to two years – need to be more cautious when selecting a fund. “As interest rates started bottoming out last year, some debt funds have been investing in riskier papers for higher returns. In short term funds, fund managers should not take credit or duration risk,” says Vidya Bala, Head of mutual fund research at Fundsindia.com.

Bala suggests that when selecting an ultra-short-term or a short-term fund, investors should avoid schemes that have given returns higher than the category average. “Higher returns show that the fund manager took unwanted risk,” says Bala. When long term funds, such as credit opportunity, opt for riskier papers they usually put processes in place to recover money in case of defaults. Mutual funds take collateral from borrowers in such cases. It could be an asset or shares of a group company or a project generating cash flows. In short term debt funds, similar safety measures are usually not sought.

For a retail investor, it’s not easy to analyse the portfolio of a debt fund. Experts say the only option is to stick with larger fund houses. In case of short term funds, opt for those who have returns close to the category’s average. Always match your investment horizon with that of average portfolio maturity of the scheme. If an issuer in your debt fund scheme is downgraded, give the fund house at least three months to tackle such problems.

)