Fiscal road map, dollar to dictate market direction

Markets would be keeping an eye on the North Korea-US stand-off

)

premium

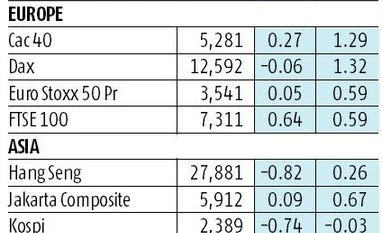

Indian markets, which posted their biggest fall in 10 months on Friday, are likely to remain under pressure in the coming days, as investors await more clarity on the country’s fiscal road map from the government. Meanwhile, strengthening of the dollar, escalating tensions between North Korea and the US, a fall in commodity prices are also expected to make global investors wary of risky assets like emerging markets, including India.

The Nifty 50 on Friday lost 1.6 per cent to end at 9,964, while BSE Sensex lost 1.4 per cent to close at 31,922.4. The rupee, after dropping to a six-month low of 65.16, ended the week at 64.8 against the dollar.

Experts said the immediate concern for investors is whether the government is able to boost economic growth without straying much from the fiscal consolidation path. There is growing pressure on the government to boost the economy after gross domestic product (GDP) growth fell to 5.7 per cent in the June quarter.

The Centre is planning to spend as much as Rs 50,000 crore to provide a stimulus to the economy. While experts are not sure how soon such a measure to prop up growth rates and to what extent, economists say this could increase the fiscal deficit to as much as 3.7 per cent, from the budgeted 3.2 per cent, of the GDP. Fiscal expansion is likely to put upward pressure on bond yields and dash market hopes of interest rate cuts by the Reserve Bank of India (RBI).

The Nifty 50 on Friday lost 1.6 per cent to end at 9,964, while BSE Sensex lost 1.4 per cent to close at 31,922.4. The rupee, after dropping to a six-month low of 65.16, ended the week at 64.8 against the dollar.

Experts said the immediate concern for investors is whether the government is able to boost economic growth without straying much from the fiscal consolidation path. There is growing pressure on the government to boost the economy after gross domestic product (GDP) growth fell to 5.7 per cent in the June quarter.

The Centre is planning to spend as much as Rs 50,000 crore to provide a stimulus to the economy. While experts are not sure how soon such a measure to prop up growth rates and to what extent, economists say this could increase the fiscal deficit to as much as 3.7 per cent, from the budgeted 3.2 per cent, of the GDP. Fiscal expansion is likely to put upward pressure on bond yields and dash market hopes of interest rate cuts by the Reserve Bank of India (RBI).