Put together, the number of shares in fund managers’ holdings, by end-February was 233.8 million, against 232.1 million at end-January.

Overall allocation to PNB in terms of assets, however, is marginal.

“We did not expect the fall to be so fast and steep. It was only when shares cracked below Rs 125 that we started buying,” said a fund manager.

Fingers are crossed at this juncture. Some say it looked like a good value buy. If their bets go as expected, this buying could reward them heavily over the next one to two years.

Industry insiders told Business Standard one reason fund managers chose not to sell PNB was the timing. “If they had sold later, when the damage was already done, they would have hit their own portfolio further. The stock could have hit all the way down to Rs 60-70 or more.”

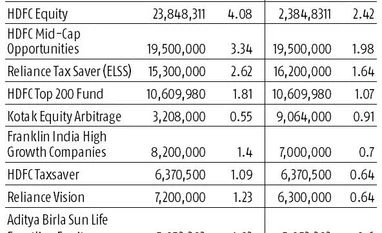

Large and established schemes like HDFC Equity, HDFC MidCap Opportunities, HDFC Top 200, HDFC Tax Saver and Aditya Birla Sun Life Frontline Equity, among others, preferred to remain invested; there was no change in the number of shares in their holdings. However, they had to face a loss in the value of these investments.

Reliance Tax Saver, HDFC Prudence and Kotak Equity Arbitrate Regular Plan, rather added PNB shares in their portfolios. On the other hand, Reliance Vision and Franklin India High Growth Companies liquidated PNB shares from their portfolios.

The total number of MF schemes with exposure to PNB shares fell in February to 94, from 116 in the previous month. This means 22 schemes altogether exited the counter. The value of total investment in PNB dropped by nearly 39 per cent from Rs 39.36 billion in January to Rs 23.92 billion last month.

)